Before diving into PTA Tax and PTA tax calculator, let’s just discuss the brief history of PTA tax in Pakistan. Before year 2019 anyone can bring mobile phone to Pakistan without paying any tax on it to Government of Pakistan. Which was a big leakage in tax collection system as well as tracking of those unregistered mobiles was not possible.

Keeping in view of this and increasing the tax revenue, Pakistan Telecommunication Authority introduced a PTA tax in which users can bring smartphones from outside Pakistan into Pakistan but will have to pay a PTA tax on that smartphone for registration. If you have new phone which is not register in Pakistan, after 60 days of arrival in Pakistan, that smartphone will be blocked by PTA. To avoid the blockage, you must pay the PTA tax. Amount of tax depends on the price of the smartphone which we will cover later in this article.

Contents

How to check PTA tax of Mobile in Pakistan?

If you want to check that how much you will have to pay to PTA on account of Mobile phone registration then you are on a right place. We will discuss step by step that how to calculate PTA in Pakistan. You can register your mobile either on Passport or CNIC. You must send the registration request from your own SIM or Passport.

Registration through Passport

The benefit for registering a device on Passport is that you will get a discount on PTA tax between 15% to 20%. Eligibility for registration via Passport:

- Past 60 days travel history is required for registration.

- You can register 5 mobiles on 1 passport irrespective of single sim or dual sim.

How to check IMEI for PTA Tax?

Before proceeding for mobile registration and tax calculation, you must check whether your mobile is already approved or not. There are multiple methods to check IMEI on PTA records. Let’s explore each method in detail.

What is IMEI number?

IMEI is stands for International Mobile Equipment Identity. IMEI is 15 digits unique number for each device. If your device is single SIM then you will have only one IMEI but if your device supports two SIM cards then your device will have two separate IMEI numbers for each SIM slot. IMEI number is located in mobile settings.

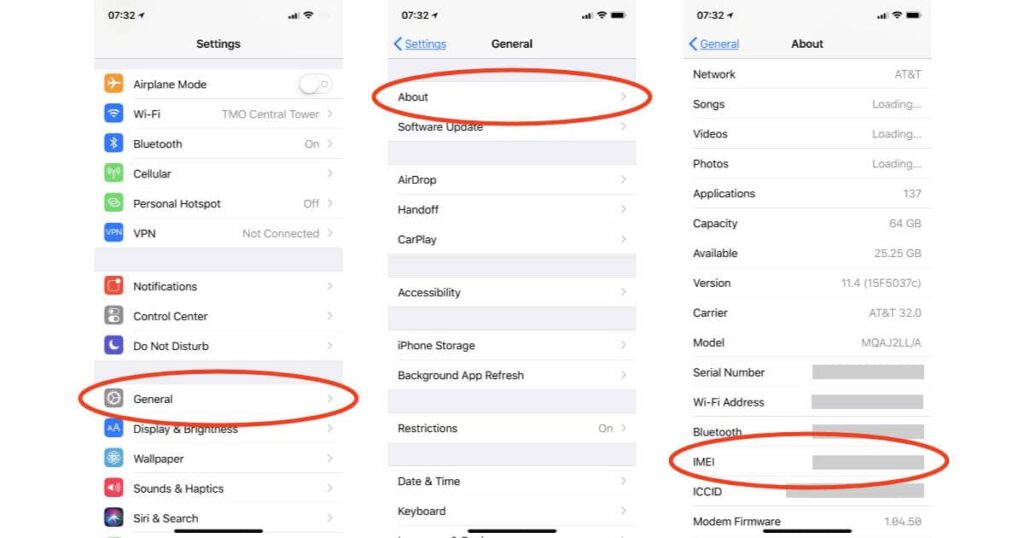

Below picture shows how to check IMEI of Iphone:

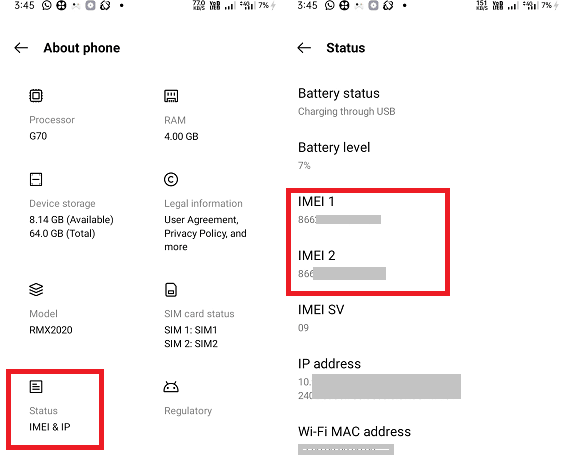

Below picture shows how to check IMEI of Android Device:

If you are unable to locate your IMEI number follow the step by step guide:

- Open your mobile device, and open the dialer of your phone.

- Enter this code *#06#.

- Your 15 digits IMEI will display.

- Save that IMEI for future use.

PTA IMEI Check through SMS

This method is more convenient and easier as not all users have access to internet. For IMEI verification info via SMS follow below mentioned procedure:

- Open your mobile messenger.

- Open New SMS box.

- Type you 15 digits IMEI.

- Send to 8484.

- In few seconds your PTA IMEI status will appear whether it is compliant, non-compliant or blocked.

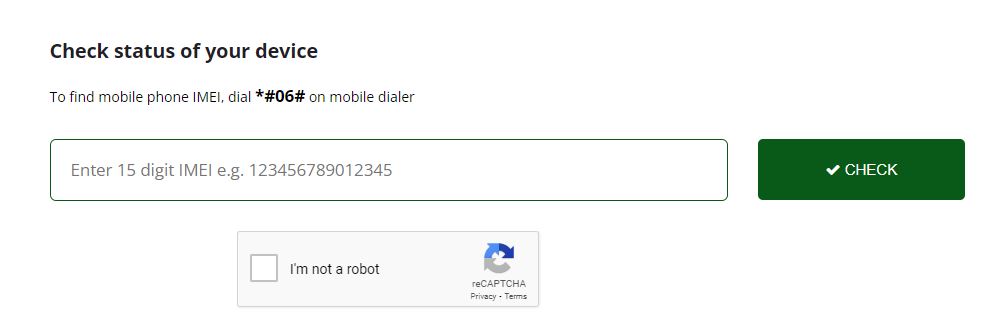

PTA IMEI Check Online via Website

If you do not want to check IMEI information of your device via SMS then Pakistan Telecommunication Authority introduced a system called DIRBS. DIRBS stands for Device Identification, Registration & Blocking System. DIRBS portal was introduced by PTA in 2019 Through which you can easily check your mobile IMEI online through website.

- Go to PTA official website or click here

- Now click on DIRBS..

- New tab will open scroll down to IMEI input box. As per below mentioned picture.

- Type your 15 digits IMEI number for IMEI verification.

- Make sure you enter the code without spaces or dashes.

- Now click on Check Button.

- System will process your request and display the IMEI information on your screen.

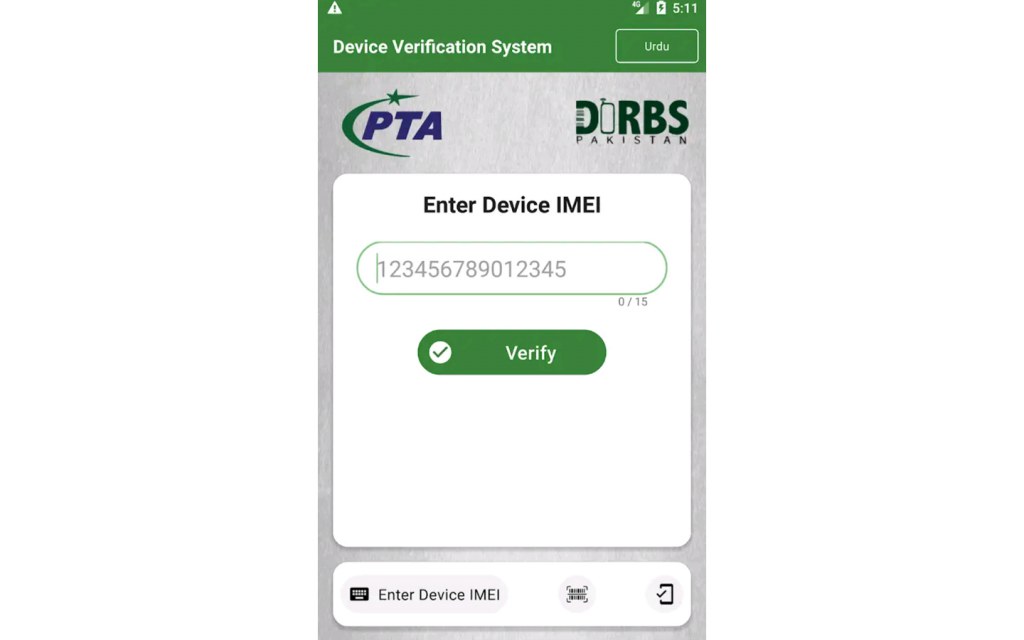

PTA IMEI Check via Mobile Application

You can also check your PTA IMEI status through mobile application.

- If you have android mobile click here to download the android DIRBS application.

- After installation open your DIRBS App.

- Enter you 15 Digits IMEI and click on Verify button.

- You will get the results either your device is Compliant, Non-Compliant or Blocked.

PTA Tax Calculator

After IMEI check, you found that your Mobile is non-compliant i.e. unregistered with PTA. Next step is to register your device by paying PTA tax but before that you need to calculate the amount of tax of your device. FBR has established a formula by which anyone can calculate the amount of tax easily. Formula is based on the price of your device. Tax amount is different for CNIC and Passport.

Click here if you want to calculate the tax on your salary.

Calculate PTA tax through Formula

FBR issued tax rate list for device registration which is as follows:

| Mobile Phones Value (US Dollars) | Registration on CNIC | Registration on Passport |

| Up to USD 30 | PKR 550 | PKR 430 |

| Above USD 30 and up to USD 100 | PKR 4,323 | PKR 3,200 |

| Above USD 100 and up to USD 200 | PKR 11,561 | PKR 9,580 |

| Above USD 200 and up to USD 350 | PKR 14,661 + 17% Sales Tax Ad Valorem | PKR 12,200 + 17% Sales Tax Ad Valorem |

| Above USD 350 and up to USD 500 | PKR 23,420 + 17% Sales Tax Ad Valorem | PKR 17,800 + 17% Sales Tax Ad Valorem |

| Above USD 500 | PKR 37,007 + 17% Sales Tax Ad Valorem | PKR 27,600 + 17% Sales Tax Ad Valorem |

PTA taxes for popular phones in Pakistan is calculated below:

PTA tax on Iphones

- Iphone 15 Pro Max price in Pakistan is PKR 671,000/- and in USD is 2,418. As per the formula PTA tax on Iphone 15 Pro Max is Rs. 151,077 for CNIC registration and Rs. 141,670 for Passport Registration.

- Iphone 14 Pro Max price in Pakistan is PKR 560,000/- and in USD is 2,018. As per the formula PTA tax on Iphone 14 Pro Max is Rs. 132,207 for CNIC registration and Rs. 122,800 for Passport Registration.

- Iphone 13 Pro Max price in Pakistan is PKR 452,000/- and in USD is 1628. As per the formula PTA tax on Iphone 13 Pro Max is Rs. 113,847 for CNIC registration and Rs. 104,440 for Passport Registration.

- Iphone X price in Pakistan is PKR 142,000/- and in USD is 511. As per the formula PTA tax on Iphone X is Rs. 61,147 for CNIC registration and Rs. 51,740 for Passport Registration.

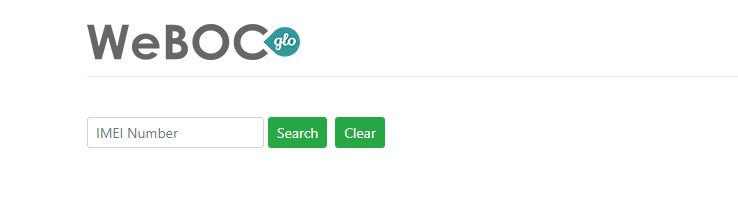

Calculate PTA tax through Official Website

If you can not calculate the amount using formula stated above then you can calculate the amount through PTA official website.

- Go to weboc.gov.pk or click here. Website will open as per picture mentioned below:

- Enter your mobile phone IMEI number and click on search.

- Your total Duty/Tax will be displayed to you with following details.

- Tax amount

- GSMA TAC

- Brand as per GSMA

- Product Description

- Marketing Name as per GSMA

- Manufacturer as per GSMA

- Model as per GSMA

How to pay PTA tax/How to register phone in Pakistan?

Now that you have calculated your tax amount next process is to pay that tax to Government of Pakistan. Make sure you have following information with you before proceeding for PTA registration.

- IMEI

- CNIC or Passport number

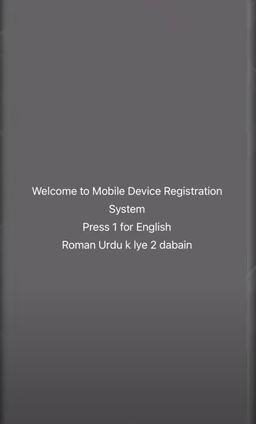

Step for PTA Mobile Registration

- Go to your mobile dialer and dial *8484#.

- Now select your desired language press 1. for English and press 2. for Roman Urdu.

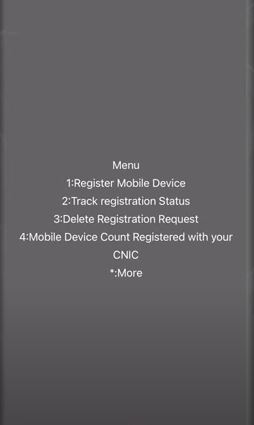

- After language selection, menu section will appear with 4 option:

- Register Mobile Device

- Track Registration Status

- Delete Registration Request

- Mobile Device Count Registered with your CNIC

- Press 1 for Register Mobile Device.

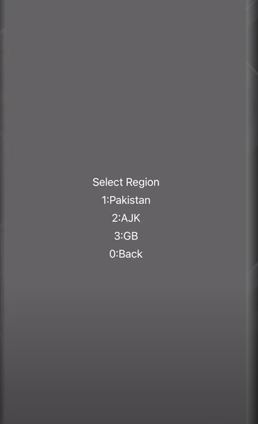

- Now select your region that is 1. Pakistan, 2. AJK, 3. GB, 0. Back

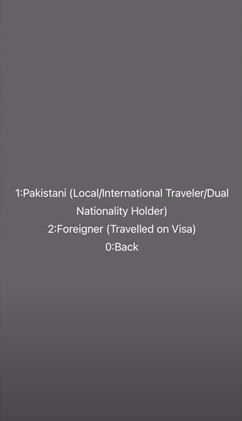

- Press 1. If you are Pakistani and press 2. if you are Foreigner.

- Now press 1. (Mobile Registration for International Traveler) If you want to register your device on Passport and press 2. (Mobile Registration for Local) If you want to register your device on CNIC.

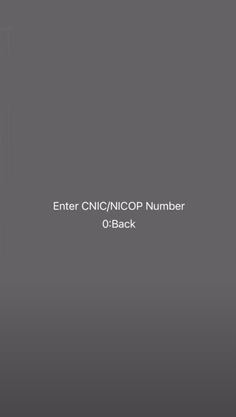

- Now type your CNIC number or Passport.

- Next step is to enter the sim type of phone, press 1. Single IMEI, press 2. Double IMEI, press 3. Triple IMEI

- Now enter IMEI number as per your selection.

- Press 1. For confirmation. Make sure you read your all the details before confirmation.

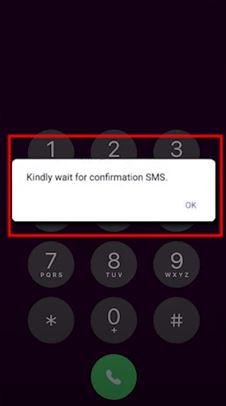

- Finally, your request has been submitted, upon processing confirmation message will be sent along with tracking ID, tax amount and PSID. (What is PSID and how to Pay PSID)

Payment of PTA tax:

After receiving the PSID number on your mobile you can pay that PSID by visiting the bank along with cash or Cheque. You can also pay you PSID through online mobile application.

For Online payment open your bank mobile application,

- Go to tax payment option.

- Click on FBR.

- Type your PSID number.

- Click on pay.

After payment of PTA tax your IMEI will be registered with PTA.

Benefits of PTA approved Devices

- You will have the access to all the features of device.

- SIM will be active on your device you can use SIM for calls, SMS or internet usage. In non-approved PTA devices SIM features provided by local mobile networks don’t work.

- Banking and some other application don’t work on non-approved devices.

- Using non-approved devices is unethical as well as a crime by law.

- PTA approved devices can be tracked in case of theft.

Conclusion

PTA has taken a great initiative to control use of unapproved devices. To enjoy the seamless features offered by local mobile networks it is important to register your device with PTA and pay tax to increase the revenue for Pakistan’s growth. We have covered each and every aspect of PTA tax, IMEI verification and PSID payment. By following the above guide, you can easily complete your device registration.

Also Read:

How to verify NTN by CNIC online?

Frequently Asked Questions

1. If you want to calculate the PTA tax of your device go weboc.gov.pk

2. Enter your mobile phone IMEI number and click on search.

3. System will display total amount of tax.

Every phone brought to Pakistan must be register with PTA against IMEI and CNIC or Passport number of the user. For IMEI approval, PTA charge tax called PTA tax.

There are two methods for checking the PTA approved phone:

1. To check PTA approved phone, send 15 digits IMEI number to 8484.

2. Go https://dirbs.pta.gov.pk/ type your mobile IMEI number and press Check button.

1. Go to your mobile dialer and dial *8484#.

2. Provide the necessary information.

3. After completion of registration process you will receive message along with PSID and tax amount.

4. Go to your nearest bank branch and pay the tax against that PSID number.

5. You can also pay the tax by banking mobile application.

No PTA tax is not free on passport, but reduced rate is charged for Passport registration compare to registration with CNIC.

Maximum 5 devices can be registered against one passport.

To check IMEI, from your mobile dial pad, type *#06#. Or go to your mobile settings and search for IMEI.

PTA allows 60 days for mobile registration after you insert the local network provider’s SIM. After that 60 days unapproved mobile will be blocked by PTA. And you can not use the services of network providers.