In the era of current economic situation, paying taxes on timely basis is important for every individual as well as for business to ensure the compliance with tax regulations. Paying taxes is not only a moral responsibility of every Pakistani but also important as growth of a Pakistan as a whole. In today digital world, where everything is easily accessible, keeping in view of this recent significant change, FBR also introduce a Active Taxpayer List (ATL). This tool helps taxpayer to easily track their tax status and this also helps the FBR to increase the number of taxpayers.

Contents

What is Active Taxpayer List (ATL)?

Active Taxpayer List is a record maintained by FBR pertaining to pervious tax year. This list contains the information regarding the taxpayer who are registered and are filing their returns on timely basis. The Federal Board of Revenue publishes this list on every first day of March, which is valid for next February of fiscal year. For example, Active Taxpayer list for the tax year 2023 was published on 1st March, 2024 which will remain valid till 28th February 2025. Moreover, Active Taxpayer List is update on every Monday by FBR.

How to check Active Taxpayer List (ATL)?

If you want to check your current tax status whether you are Active or Inactive, for this follow the step by step guide stated below:

Method 1: Online Active Taxpayer List Status

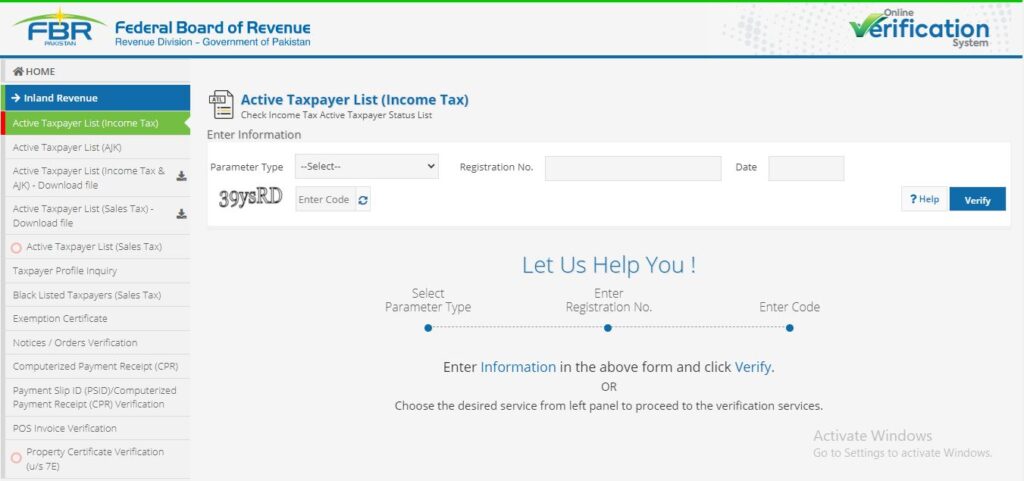

- Go to the FBR official website or click here

- After opening the FBR website you will see the screen in the picture, from left top corner of the tab click on “Active Taxpayer List (Income Tax).

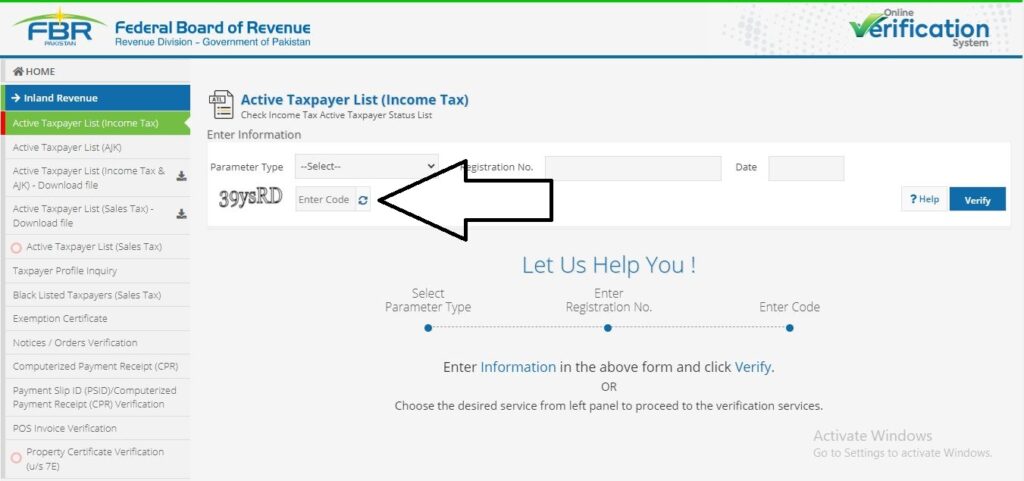

- A following screen will open will multiple fields.

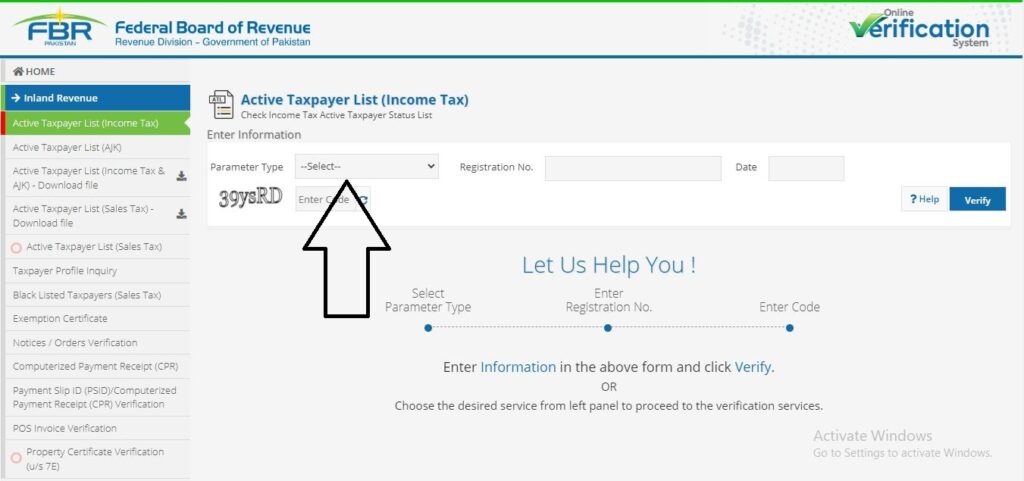

- Now the next step is to select “Parameter Type” i.e. CNIC, NTN, Passport No or Reg/Inc No.

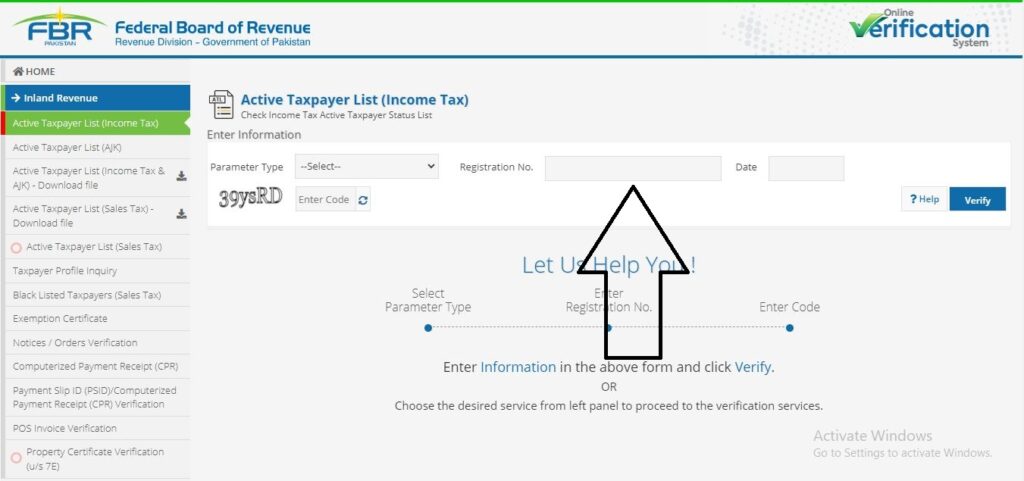

- After selecting the required parameter field, in “Registration No.” field enter your NTN number.

- Now from “Date” field enter the date for which you want to check the Active status.

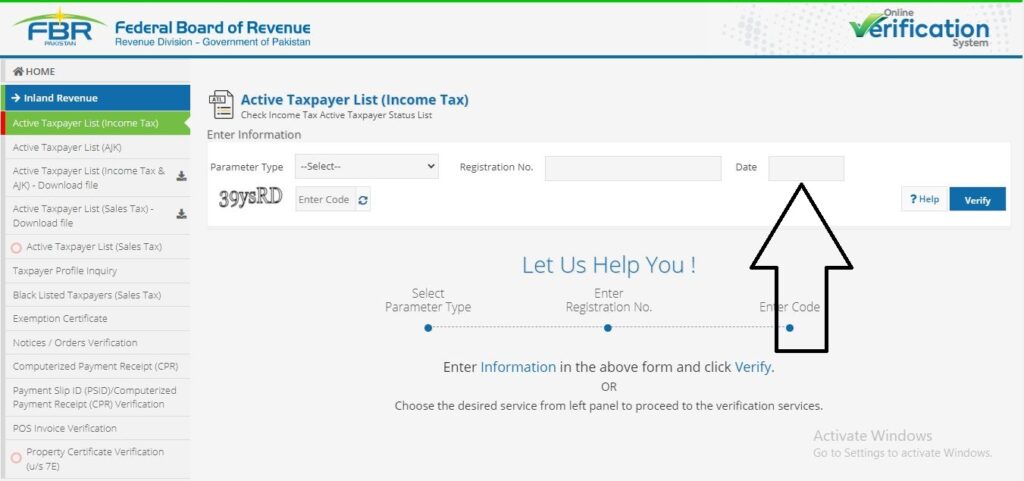

- After selection of date, in “Enter Code” field enter the Captcha on the screen.

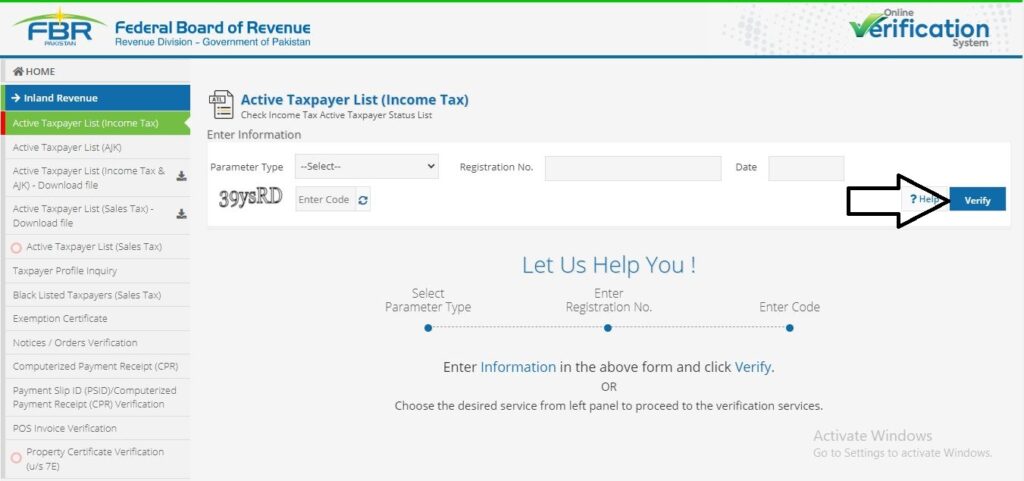

- And now final step is to click on “Verify“. After few seconds your taxpayer status will be displayed to you. Whether Active or Inactive.

Method 2: Check Via SMS on Mobile:

- If you want to check the active taxpayer status of individual:

Type “ATL (Space) CNIC number (13 digits) and send to 9966.

- If you want to check the active taxpayer status of AOP and Company:

Type “ATL (Space) NTN number (7 digits) and sent to 9966.

- Active Taxpayer Status of AJ&K

For individual: type “AJKATL” (Space) CNIC (13 digits) and send to 9966.

For AOP and Company: type “AJKATL” (Space) NTN number (11 digits) and send to 9966.

Method 3: Download Active Taxpayer List

Another method is to download the ATL from FBR portal of click here to download latest ATL.

How to remain active in Active Taxpayer List?

To remain Active in ATL, a person should file the tax return related to the tax year of the relevant ATL. For example, to remain the part of ATL uploaded on 1st March 2024, a person must have filed his return for the tax year 2023. Similarly, to remain the part of ATL that will be uploaded on 1st March 2025, a person must file the tax return for the tax year 2024.

Through Finance Act 2019, to remain in ATL person must file the return before the due date, if a person filled the return after due date that person must pay a surcharge to be the part of ATL.

| Type | Penalty |

| Individual | PKR 1,000 |

| Associations of Persons (AOP) | PKR 10,000/- |

| Company | PKR 20,000/- |

To pay this “Surcharge for ATL” click on the Tax Payment Nature “Misc” head in PSID. After this payment late filer can become the part of ATL.

What are the benefits of being on the Active Taxpayer List?

Following are the benefits for being the part of ATL:

- At source, bank deduct lower rates for active status holder on profits and cash withdrawals.

- Lower rates of withholding will be charged to active status holders on registration or transfer of a vehicle. For example, if you are purchasing a vehicle for which withholding tax for active is PKR 25,000 and for Inactive PKR 75,000 respectively was defined by FBR. And if you are Active in taxpayer list then you will pay lower rate which is PKR 25,000.

- Lower rate of tax will be charged to you, if you are purchasing or selling and property.

- Lower withholding rate will be charged to you upon capital gains on sale of securities.

- On dividend lower tax charges will be charged.

- On prize bond winnings lower rate of withholding will be charged.

- You can claim the overpaid tax which has already be withheld at source.

How to become Active Taxpayer?

If you want to become the active taxpayer, you have to register your self with FBR. Registration with Federal Board of Revenue is simple. Most of the people find it difficult to get their self-register with FBR, so worry not because in our detailed registration step by step guide you can register with FBR.

Conclusion

In final words, Active Taxpayer List (ATL) maintained by FBR is a centralized record for active taxpayers of Pakistan who are registered with FBR on IRIS for tax compliance and are timely and promptly fulfilling their regulatory requirement of filing the tax return. Being on the ATL signifies that the individual or company is compliant with the tax obligations. As this list is regularly used by the financial and government departments to verify the tax status of individual or company.

Frequently Asked Questions ( FAQ)

Active Taxpayer List is a record maintained by FBR pertaining to pervious tax year. List shows the information for individuals and companies who have filled their tax return in previous tax year.

You can check your active taxpayer status by online and via SMS. To check online go to FBR website and select “active Taxpayer List (ATL)” tab and enter required fields and click verify. And to check active status on mobile

For individual: Type “ATL (Space) CNIC number (13 digits) and send to 9966.

For AOP and Company:

Type “ATL (Space) NTN number (7 digits) and sent to 9966.

Yes, you can verify your NTN online, for detailed step by step guide click here.

FBR update Active Taxpayer List on every Monday.

FBR upload ATL on 1st March of each year, which remains valid till 28th February of next year.

If a person or Company filled a tax return after due date, to remain on ATL they have to pay Surcharge on ATL.

1 .Individual Rs. 1,000/-

2. AOP Rs. 10,000/-

3. Company Rs. 20,000/-

Clicking on Tax Payment Nature “Misc” head in the PSID. As defined in section 182(A) of Income Tax Ordinance 2001.

SRB stands for Sindh Revenue Board. SRB looks after the sales tax on services rendered in province of Sindh.