In todays world, compliance to tax related matters is very important for individuals as well as for businesses. In Pakistan understanding your FBR filer status is very crucial. Whether you are individual of a business entity, registration with FBR and becoming Active Taxpayer can have significant implications on your financial matters. In this article we will discuss what is FBR filer status and how to check your NTN filer status.

Contents

What is FBR Filer?

An individual, AOP or company registered with Federal Board of Revenue and filling their tax returns on timely basis is called FBR filer. FBR is the regulatory authority in Pakistan for collection of taxes. This refers to whether a taxpayer is registered with FBR and fulfilling the tax obligations. If an individual, AOP or Company is not registered with FBR and not filling the tax return then they will be categorized as FBR Non-Filer.

Benefits of Active Taxpayer / FBR Filer

Becoming an FBR filer is very important for various reasons. Firstly, is signifies that you are a good citizen of Pakistan by filing your tax return and contributing towards the economic growth of the country. Additionally, FBR introduced a separate tax slabs for filers which is lesser compared to tax slabs of Non-filers. FBR filer makes you eligible for various tax exemptions, deductions which helps in reduced tax burden.

If you are a filer than you will be charged lower rate of tax deduction on profits and cash withdrawals. Becoming filer will also help your in reduce withholding tax on transfer or registration of vehicle. Active tax filers can adjust their withheld income tax. Most of the time businesses prefer to do business with FBR filers rather than non-filers.

Consequences of Not being Filer

Non-filers may face penalties, fines and even legal actions for non-compliance with tax regulations. Non-filers are charged a higher rate of taxes. Moreover, being a non-filer can limit your business activities, because many vendors and businesses prefer dealing with active taxpayer or FBR filers.

How to check FBR Filer Status?

Active Taxpayer Status Online

In todays digital world, checking your FBR Filer Status is easier than ever. You can check your FBR filer status through online portal provided by FBR. Follow below mentioned steps to verify your filer status.

- Go to official website of FBR.

- Scroll down until you see the category “Online Services”.

- From Online Services, click on “Online Verification Portal”. New tab will open.

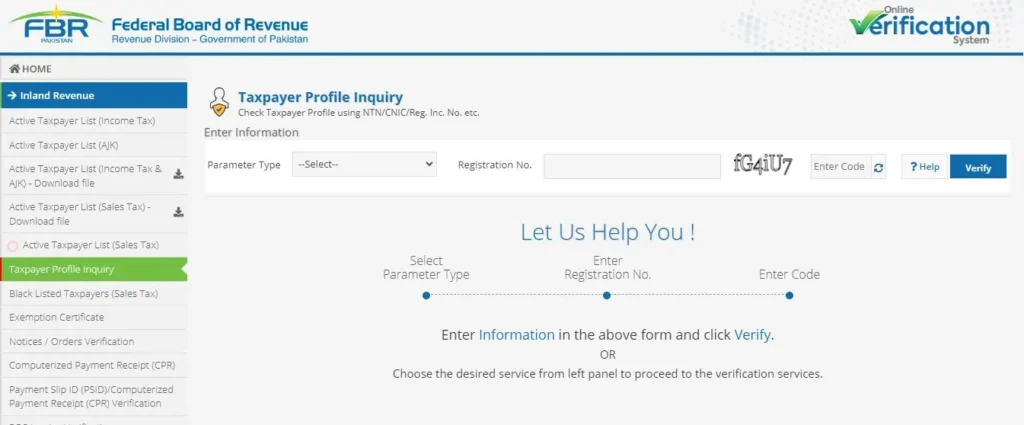

- Now from the left side of the window, click on “Taxpayer Profile Inquiry”.

- In the “Parameter Type”, select NTN, CNIC, Passport No. or Registration No.

- In the “Registration No” filed type your 13 digits CNIC no. if you selected CNIC in Parameter Type. Or type your 7 digits NTN no. if you selected NTN no. in Parameter Type.

- To proceed further, enter the Captcha Code. And click on “Verify”.

- Now system will display you the FBR filer status whether it is active of inactive.

Active Taxpayer Status Through SMS

If you want to check the your FBR filer status offline then you can check it by sending a SMS.

For Individuals: Type ATL (Space) 13 digits CNIC and send to 9966.

For AOP or Companies: Type ATL (Space) 7 digits NTN number and send to 9966.

FAQs

For Individuals, 13 digits CNIC number is treated as NTN number while for AOP and Companies 7 digits NTN number is issued by Federal Board of Revenue.

Go to FBR Website.

Click on “Online Verification Portal”

Now click on “Taxpayer Profile Inquiry.

Select CNIC in Parameter Type.

Enter your 13 digits CNIC, and click on Verify.

NTN number is stands for National Tax Number, issued by Federal Board of Revenue. for Individuals NTN is 13 digits CNIC number and for AOP and Companies 7 digits unique number is issued by FBR.

A person or business entity, registered with FBR and filling their income tax return on timely basis is called income tax filer.

A person or business entity, not registered with Federal Board of Revenue is called non-filer.

Conclusion

Whether you are an individual or a business entity, knowing your FBR Filer Status is the first step towards financial responsibility. Checking your FBR Filer status is very important for tax compliance and accessing the benefits offered by FBR.

Also Read