With the advancement in technology, every country is shifting to digitalization for every purpose. For taxation and revenue collection, technology advancement is very important. To better manage the revenue, Federal Board of Revenue established a portal called IRIS which helps the tax filers to file their income tax and sales tax return easily. In this article we will discuss the registration process, login, accessing the IRIS, benefits and implications of FBR IRIS in detail.

Contents

Overview of FBR IRIS Login

IRIS is not an acronym, IRIS is the name of the flower which represent faith, hope and wisdom. To facilitates taxpayers, tax practitioners and FBR personals to sharing information related to taxes and other tax related activities FBR established a web-based IRIS system to manage all tax related activities under one portal. IRIS was launched in 2018, a step towards paperless experience for taxpayers.

IRIS FBR Registration

For login to IRIS, first you need to register with FBR. For detailed FBR registration process click here. Procedure for NTN registration also known as IRIS registration /e-enrollment is given below:

- Go to official website of FBR or click here.

- Now scroll down to “Online Services”.

- After that click on the option called “Income Tax”. New tab will open.

- Now click on the button of “e-Enrolment”

- “E-enrolment” form will open. Enter the following details in all fields of e-enrolment form

- Your 13 digits CNIC number

- Your current service provider such as Zong, Mobilink, Jazz, Ufone, Warid and Telenor. Now enter your mobile number. Make sure you enter the mobile number register against your CNIC.Enter email and confirm email.

- Enter the Captcha code and click on “Submit”.

- After providing the information, Password and PIN will be sent to your email and mobile number.

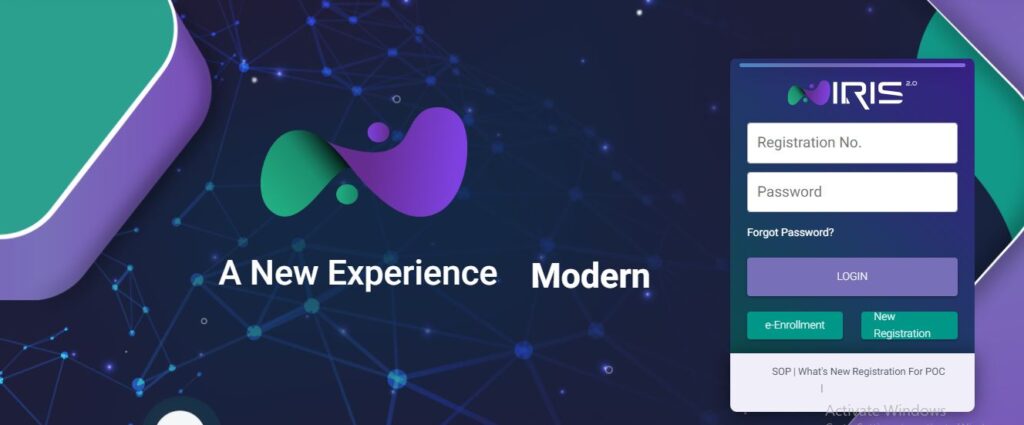

How to Login to FBR IRIS 2.0

Now that you have registered with FBR on IRIS portal with your CNIC. For further process next step, it to login to IRIS portal:

- Go to IRIS login portal of FBR.

- Enter your NTN number in Registration box.

- Enter your Password in next box. And Press Login.

- You have successfully logged into FBR IRIS 2.0.

Key Features of IRIS FBR

Online Registration: IRIS FBR offers hassle free registration for tax payment. Taxpayers can register can create profile with FBR by online.

Filling of Tax Return: Through FBR IRIS login portal, taxpayers can electronically file their tax returns unlike previously through physical forms.

Tax payment: After filling the tax return taxpayer can generate the PSID easily and submit the tax amount online through PSID number. How to generate PSID.

Access to previous tax records: IRIS maintains the previous years tax return of the taxpayer, if a taxpayer wants to access the previous tax records then simply login to IRIS and get the records.

Review and Audit: IRIS helps to facilitate assessment and audit without physical and forms and manual appearing.

Appeal: If a taxpayer wants to appeal against the FBR, IRIS provides this facility.

Reduce chance of errors: As all the tax filing process is systemized which reduces the chance of error in filling process.

Certificate Issuance: The IRIS can generate various reports, refund processing and issuance of certificate.

Integrated System: IRIS is compatible and linked with other databased of Government of Pakistan such as PRA and NADRA National Database and Registration Authority.

Benefits of IRIS FBR:

Accessibility: FBR IRIS is online portal which make it easy to accessible form all around the world. If a taxpayer is not available within the Pakistan and wants to file a return then they can easily file the return.

Accuracy: FBR IRIS include built in errors checking features, that helps the taxpayer in avoiding any mistakes. The system can accurately preform the calculation as compared to manual calculation.

Processing Time: FBR IRIS files the return faster as compared to paper filing. All the other elements associated with tax filling can be completed more quickly.

Cost Reduction: By filing the tax return on IRIS 2.0 taxpayer can save the amount of printing and courier cost that is associated with paper or manual returns.

Security: FBR IRIS offers advanced data security features to protect the taxpayer sensitive information.

Real time Updates: Records on IRIS provide real-time update to taxpayers. By this taxpayer can track and do better planning.

Environmentally Friendly: electronically filling the tax return reduces the use of papers.

Disadvantages of IRIS

While IRIS offers many advantages to taxpayers and tax authorities but it is also important to know about some disadvantages of online tax filing systems:

Technical Issues: As IRIS is online based portal which may encounter technical glitches or system errors. Which can result in delay in tax filling process.

Security Concerns: Despite of security features offered by IRIS, online tax filing system can still affect by cyber threats, hacking and data breach.

Need Internet: Using FBR IRIS you need a stable internet connection, which sometimes not readily available to all the taxpayers residing in rural or remote area of Pakistan. Moreover, online tax filing requires complex system information, taxpayers who are not familiar with technology can find it difficult to file a return.

Conclusion

In final words, FBR IRIS offers a multiple benefit to both taxpayers as well as the Federal Board of Revenue. IRIS provides real time processing, security, easy accessibility and accuracy as compared to manual traditional paper-based methods.

FAQs

Go to official website of FBR.

Now scroll down to “Online Services”.

After that click on the option called “Income Tax”. New tab will open.

Enter your NTN number and Password and click on Login button.

In case of Pakistani Individual User ID is 13 Digits CNIC number.

For Non-Pakistani Individual User ID is 7 Digits NTN.

In Case of Association of Persons (AOP) and Company 7 digits is NTN number.

NTN stands for National Tax Number, issued by Federal Board of Revenue. NTN number is unique for every registered taxpayer.

Go to the website ntnverification.pk. scroll down and click on NTN verification. New tab will open, from the left corner, select “Taxpayer Profile Inquiry“, Now from Parameter Type, select you desired input type i.e. CNIC, NTN, Passport No or Reg/Inc No. enter you NTN number and Captcha code. Now click on Verify.

Also Read:

Thank you for sharing such valuable and easy-to-understand tax information