KPRA stands for Khyber Pakhtunkhwa Revenue Authority, which was established in 2013 under the KP Finance Act 2013 to collect and manage the Sales tax on services in Khyber Pakhtunkhwa. The primary role is to impose, collect, administer the tax on services provided, rendered, received or delivered in the Khyber Pakhtunkhwa Province.

Contents

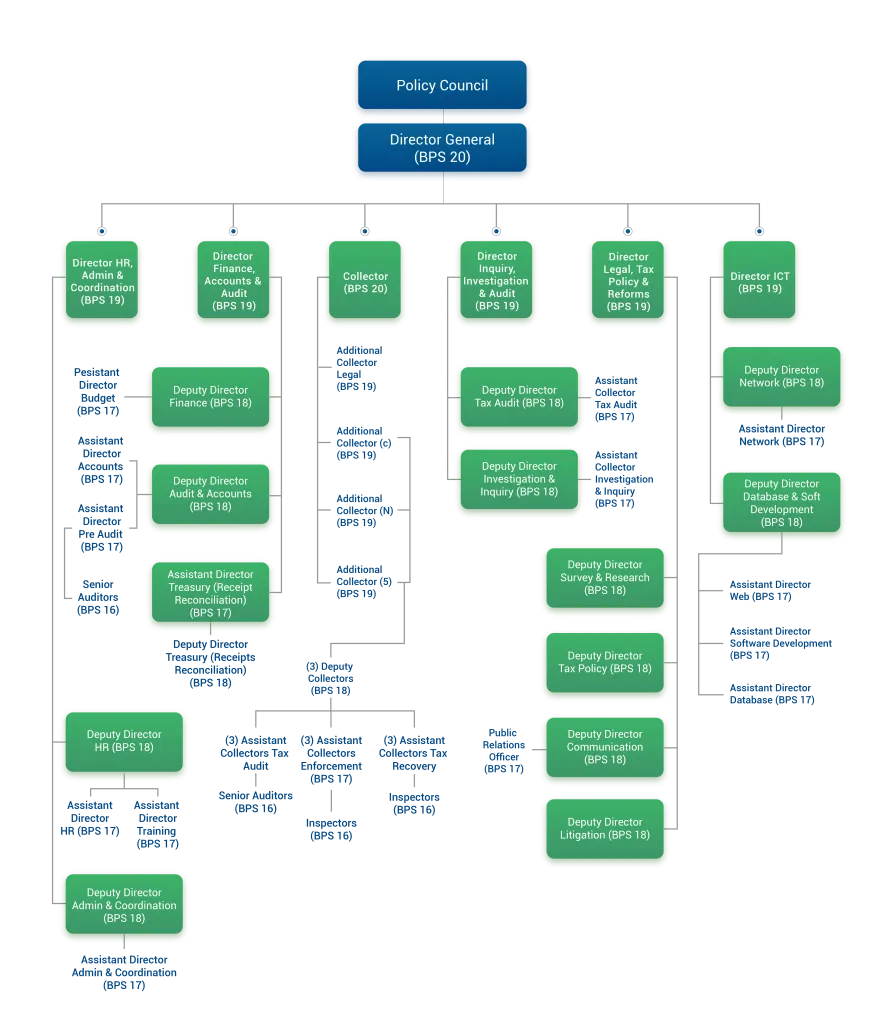

Organizational Structure

Policy Making council of Khyber Pakhtunkhwa Revenue Authority consist of Chief Minister of Khyber Pakhtunkhwa, three cabinet ministers, chief secretary, secretaries of respective departments and from private sector four representatives are nominated by the Government.

Policy making council formulate the policy guidelines related to tax administration, reforms and other matters related to sales tax. Policies prepared by the policy making council is binding on the Authority.

With the help of Directors and Collectors, Director General implement the decisions taken by Council and also submit the report on progress to Policy Making Council.

Khyber Pakhtunkhwa Revenue Authority consist of Director General who acts as a Chief Executive Officer and at least three Directors which are appointed by the Government. Organogram of Governing Bodies is mentioned below:

Revenue Collection Strategy

To administer and increase the revenues on account of Sales Tax, KPRA has established a Revenue Collection Strategy. RCS is consisting of following four primary components:

- Taxpayer Compliance Strategy

- Audit Strategy

- Withholding Strategy

- Enforcement Strategy

Along with above four strategies, Communication Strategy has also been established.

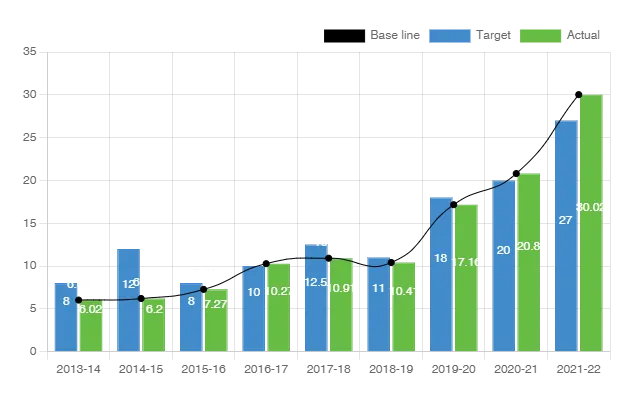

Performance of KPRA

At start in 2013, only 11 service sectors were added in Schedule 2 of KP Finance Act 2013. But later on, in 2014-15 to 2016-17 more service sectors were included in Schedule 2. And in 2017-18 total taxable service sector count reached to 91.

At the start of financial year 2013, KPRA only registered 7 persons but at the end of the financial year 2013 308 persons were registered with KPRA. And in December 2017, 1160 persons were registered with KPRA and were filling their monthly tax returns.

Initially in 2013-14, KPRA set the target for collection at Rs.6 billion but KPRA collected more than targeted which is 6.02 billion rupees. Financial year 2014-15, without proper calculations and empirical evidence, KPRA set the target of Rs.12 billion but only Rs.6 billion was collected.

In financial year 2015-16 Rs.8 billion targets were set but only Rs.7.2 billion could be achieved. In financial year 2016-17 KPRA collected the revenue of Rs.10.27 against the set target of Rs.10 billion. The figures show that decision to transfer the sales tax to provinces such as Punjab Revenue Authority, Sindh Revenue Board was correct.

FBR vs KPRA

Before 2013, Federal Board of Revenue used to collect the sales tax on services and distribute it to among the provinces. In thirteen years from 2001 to 2013 FBR only collected Rs.22.8 billion where as only in four years that is 2013 to 2017 KPRA collected Rs.29.5 billion.

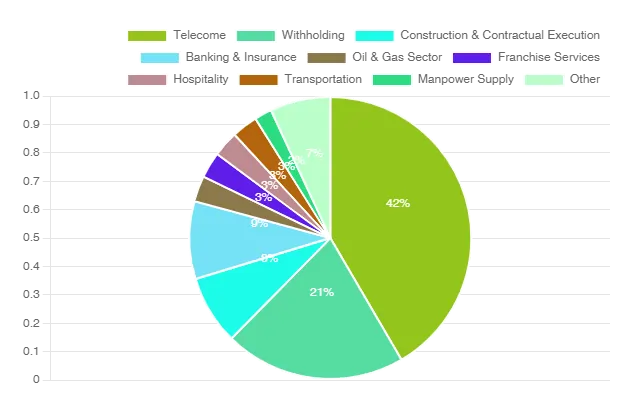

Major Sectors

Following is the list of major sectors revenue collection.

| Sr. | Sector | Percentage |

| 1 | Telecommunication | 42% |

| 2 | Withholding | 21% |

| 3 | Banking & Insurance | 9% |

| 4 | Construction and Contractual Execution | 8% |

| 5 | Oil and Gas | 3% |

| 6 | Franchise Services | 3% |

| 7 | Hospitality | 3% |

| 8 | Transportation | 3% |

| 9 | Manpower Supply | 2% |

| 10 | Other | 6% |

Key Initiatives by KPRA

Broaden Tax Base

To increase the tax collection, data related to hotels and restaurants working in Naran Valley was collected and they were issued a notice regarding the registration for sales tax return filling and tax submission. To educate the owners of the restaurants and hotels, informational workshops were organized. In response to this owner shows a positive response which resulted in increase in tax revenue.

Online Portal

To facilitate the taxpayer, KPRA introduced the online web portal. By using this KPRA login portal taxpayers can register themselves, file a tax return and maintain the records.

How to Register with KPRA?

If you want to e-register with KPRA, follow the below mentioned steps.

If you Have NTN No.

- Go KPRA official website

- From the top, click on the button “e-Registration”

- Now click on “New e-Registration having NTN”. Taxpayer Registration Application form will open.

- Now enter you NTN number, system will fetch the information from FBR portal.

- Enter the Captcha code and click “OK”. After that a registration form will appear.

- Enter your registration details in the “Registry” section.

- In the Agent Particulars u/s 71, enter the details of your representative. And save the registry.

- In the next section, provide the particulars of Directors/Shareholders of your company.

- Add other Activity details (if any) apart from your principle activity.

- In the Business/Branches section, provide the details of your branches location, if you operate from more than one location.

- In the Bank Account section, provide the information of your Bank Accounts.

- In the Declaration section, you agree that information provided is correct and complete.

- Now save the form.

- After providing all the necessary information click on “Verify Application”. In the verification popup window enter your CNIC/NTN/PP to verify.

- After verification click on “Submit Application”

- After that you will received an Activation Code on your mobile and email address.

- Now e-enroll to active your KPRA login portal, to avail the online services offered by KPRA.

Not Having NTN no.

If you do not have NTN number but want to register with KPRA, follow the procedure.

- Khyber Pakhtunkhwa Revenue Authority will issue you a 30 days Provisional Registration Certificate.

- You can access the KPRA login online portal facilities like other NTN registered taxpayers.

- In 30 days if you could not get your NTN no. then your registration with KPRA will be cancelled, and you will be informed through e-mail.

FAQ

The primary role of KPRA is to impose, collect, administer the tax on services provided, rendered, received or delivered in the Khyber Pakhtunkhwa Province.

KPRA stands for Khyber Pakhtunkhwa Revenue Authority, KPRA was established in 2013 under the KP Finance Act 2013 to collect and manage the Sales tax on services in Khyber Pakhtunkhwa.