Welcome to ntnverification.pk, in this article we will discuss the step by step guide that how to do online NTN verification by CNIC. In today’s digital world, everybody has access to internet and electronic devices such as computers, mobiles etc. so NTN verification by CNIC has become easier and convenient for those who have access internet and computer. With the following multiple online services offered by Federal Board of Revenue (FBR) online NTN verification by CNIC is one of them, used by individuals and businesses to verify tax registration status associated with particular CNIC.

Contents

What is NTN?

Before delving into the detailed step by step guide, lets understand why NTN is and why it is important. NTN stands for National Tax Number, is a unique tax identification number issued by Federal Board of Revenue to individuals and business for tax related matters in Pakistan.

- For Individual 13 Digits NTN is issued by FBR

- For AOP/Company 7 Digits NTN issued by FBR

Methods of NTN Verification?

There are following methods available for NTN verification by CNIC.

- Online Verification

- SMS Verification

- Manual verification through FBR offices

However, in this article we will focus on the online verification method by CNIC.

Online NTN Verification by CNIC – Step by Step Process

- To start the NTN verification, visit the official website of Federal Board of Revenue or Click here.

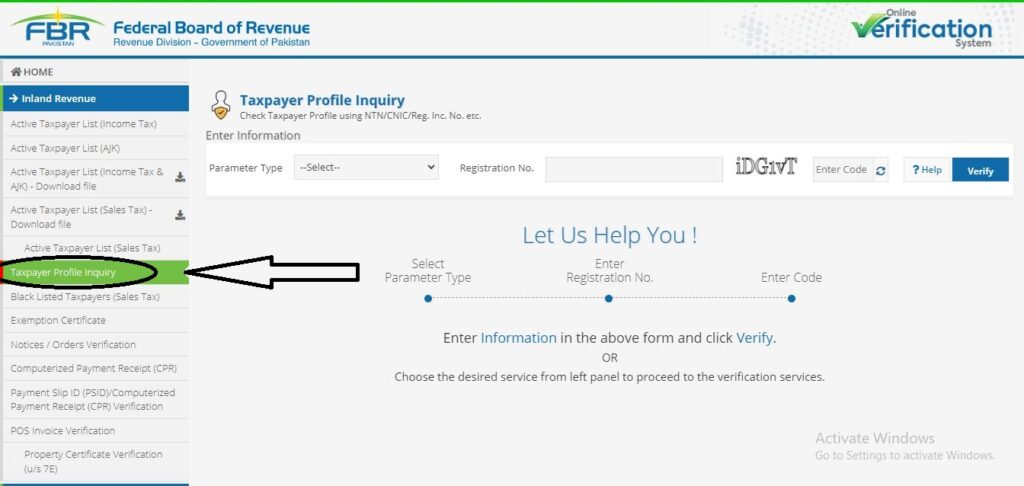

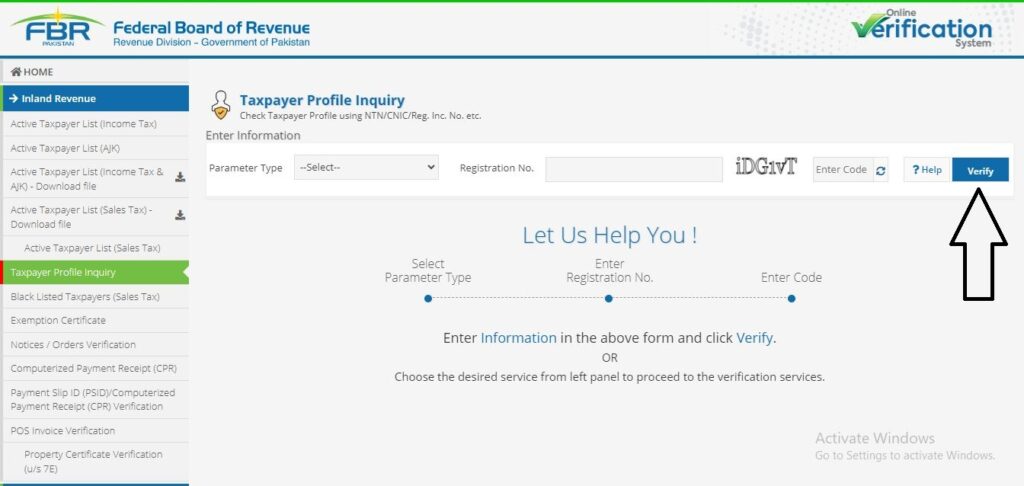

- Once on the portal, you will see the below mentioned screen. From the left corner of the screen click on the “Taxpayer Profile Inquiry”.

- New tab for taxpayer profile inquiry will open.

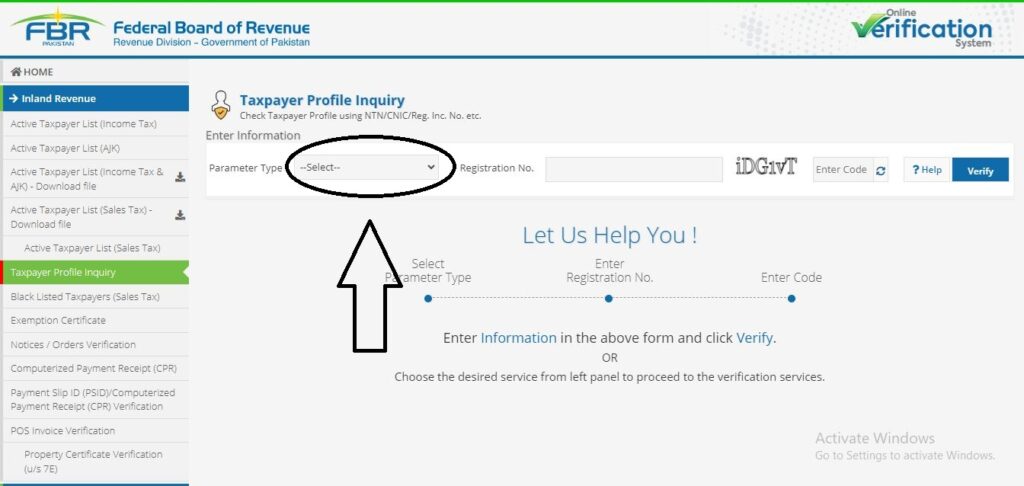

- Now from Parameter Type, select CNIC.

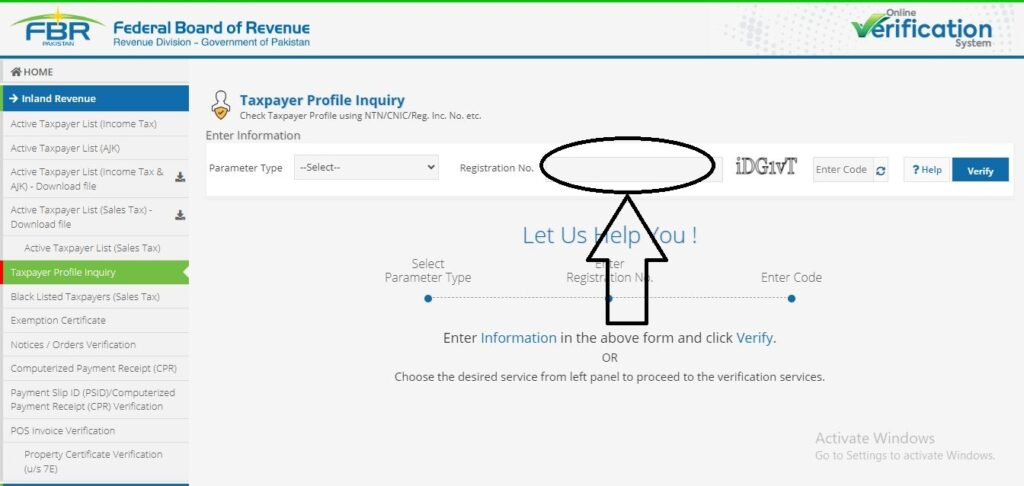

- In Registration field, enter your 13-digit unique CNIC issued by NADRA.

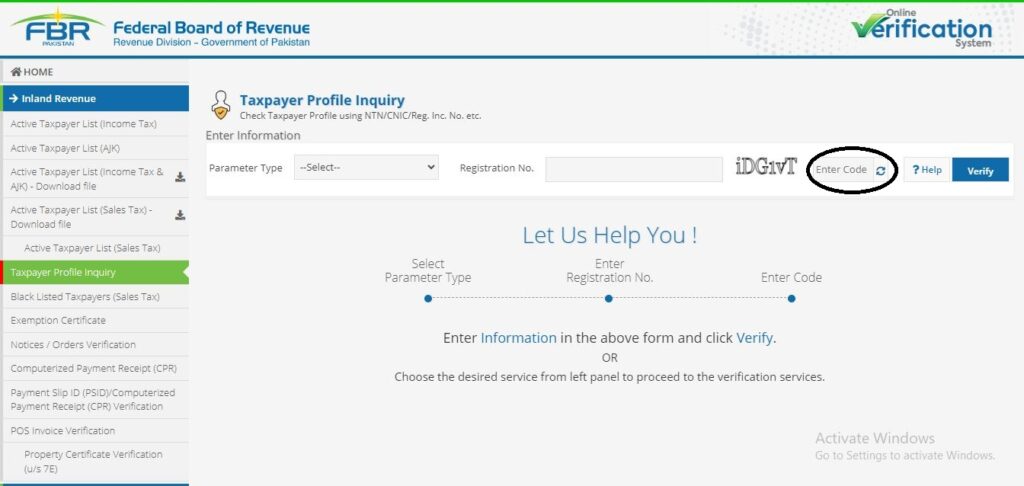

- In “Enter Code” field, enter the Captcha displayed on the screen.

- Final step is to click on “Verify” button. After entering the correct information into respective fields, system will process your request and provide the results to you.

Documents Required for NTN Verification by CNIC?

You need following items to verify NTN from Federal Board of Revenue records.

- 13 Digits CNIC

- A stable Internet

- Web Browser

Fees for Online NTN Verification by CNIC?

Federal Board of Revenue provided free service for verifying NTN online. So there is no cost associated NTN verification online.

Benefits of Online NTN Verification:

There are several benefits of NTN verification Online such as

Time Saving: you can easily verify the tax easily and quickly.

Convenient: Online NTN verification is very convenient.

Free of Cost: No fee is associated with online NTN verification.

Availability 24/7: You can verify the tax status at any time.

Conclusion

In final words, NTN stands for National Tax Number, Federal Board of Revenue offers a multiple online services including online NTN verification by CNIC. this method is very convenient and efficient without any cost.

FAQ

Yes, FBR offers a service in which you can verify your NTN by CNIC.

There are several methods for NTN verification including Online and Offline.

For NTN verification, click here and follow the step by step guide.

For Individual Active Taxpayer: Type “ATL (space) 13 digits “CNIC number” and send it to 9966.

For AOP and Company: Type “ATL (space) 7 digits NTN number” and send it to 9966.

There are no charges for online ntn verification.