PRA stands for Punjab Revenue Authority, PRA is a governmental organization established to look after the tax related matters and tax collection system in Punjab province of Pakistan. The primary objective of PRA is to broaden the tax base, increase revenue generation and ensure the compliance and efficiency in tax collection in Punjab. To streamline the tax related tasks, PRA implemented a PRA login or PRA IRIS portal. Which enables the taxpayers to ensure the tax compliance more conveniently. In this guide we will discuss how to register on PRA login portal.

Responsibility of Punjab Revenue Authority is to overview the various taxes in Punjab such as sales tax on goods, sales tax on services, property tax and professional tax etc.

Contents

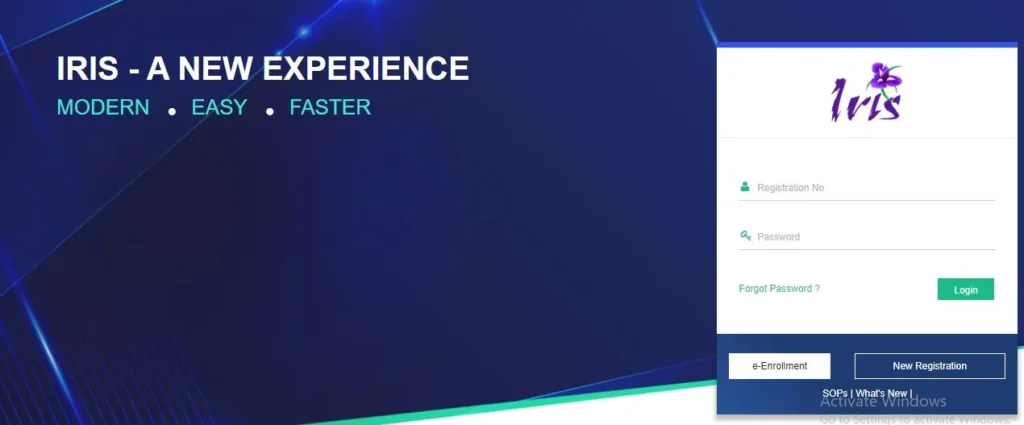

PRA Login / PRA IRIS

Punjab Revenue Authority has implemented an IRIS portal to streamline tax administration and help taxpayers to get themselves registered with PRA and perform tax related matters more easily. PRA IRIS helps taxpayers to file their tax return more quickly to save time. In this article we will discuss how to use PRA IRIS, PRA Registration and PRA verification in detail.

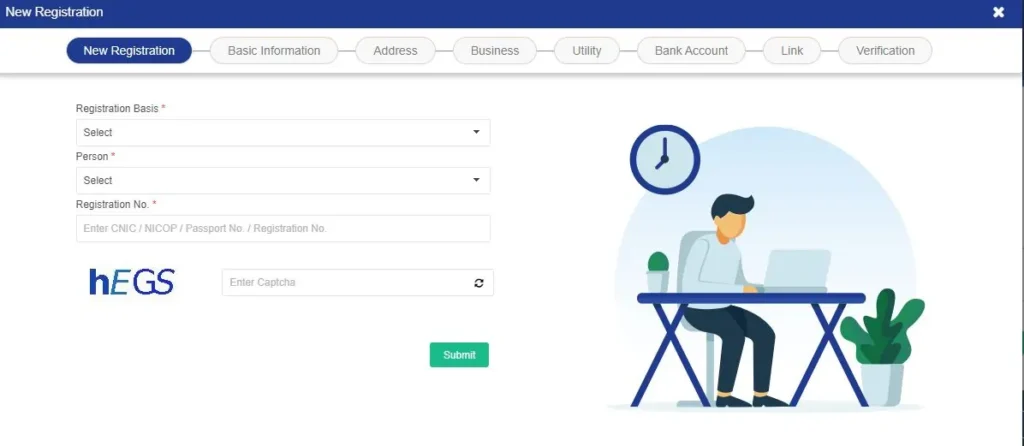

PRA Registration

There are following two types of registration on PRA IRIS. We will cover both registration step by step.

- Voluntarily

- Notice/Compulsory

PRA Voluntarily Registration

If you want to register voluntarily with PRA follow below mentioned procedure.

- Go to PRA official website or click here

- Now click on “New Registration” to proceed further.

- Registration form will open, fill the form with relevant details. The fields mark with * are compulsory to fill.

- Select “Voluntarily” form Registration Basis.

- In person field select your desired option such as Individual, Association of Persons, Company.

- In Registration No. field enter you CNIC/NICOP/Passport No. or Registration No.

- Enter the Captcha and press submit.

- Verification code will be sent to your email and registered mobile no. Enter that code and click on “Next”.

- In “Basic Information” screen, information will be fetched from FBR IRIS database, which cannot be edited. Click on “Next” button to proceed further.

- In “Address” form enter your address if that is not fetched from FBR IRIS database. Now click on “Next” button.

- “Business” form will open, enter the business information if details are not fetched from FBR portal.

- The next form will be open regarding “Utility”. Click on + button to add the utility information and click OK to proceed further. Now click on “Next” to proceed to “Bank Account” field.

- In the Bank Account field click on + to enter the bank account details. Enter the relevant bank details and click OK.

- In the next step taxpayer will provide the relevant link to do that click on + button and enter the required details and press OK.

- In the last step of “Verification” taxpayer will be shown an undertaking, make sure to read the undertaking and click on “Confirm”.

- After confirmation taxpayer will receive the password on the email and mobile no. which he can use to login to PRA IRIS.

Registration Notice/ Compulsory

Notice Bar Code

- Go to PRA website or click here

- From Registration Basis click on “Notice/Compulsory”.

- In the “Notice Bar Code” enter the notice bar code to proceed further.

- Next process for registration is same as “Voluntarily Registration” as mentioned above.

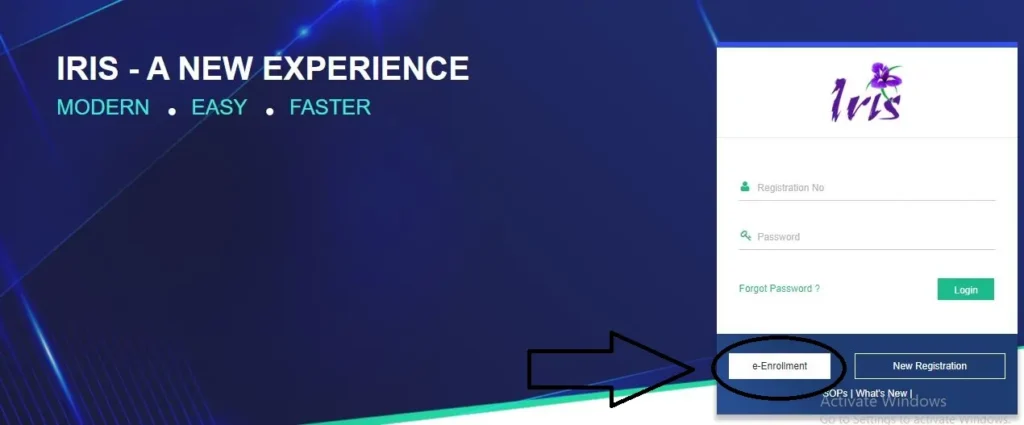

PRA e-Enrolment

After the registration with PRA, user will be required to complete e-enrollment to login to PRA IRIS portal. Follow the steps to complete e-enrollment in PRA IRIS.

- Go to PRA website

- Click on “e-Enrollment” button. New form will open.

- In the e-Enrollment form enter the following details.

- CNIC/Registration No.

- Choose your service provider

- Enter Cell No.

- Enter email address

- Fill the Captcha and click on “Submit”.

- After that, verification code from PRA will sent to user cell no. and on email address. Enter those codes and click on submit button.

- In final step user will enter ID and Password on PRA IRIS login section and click on login button. User will see a notification regarding successful PRA registration.

Features of PRA Login/PRA IRIS

Online Tax Return Filing

PRA login portal provides the facility to taxpayer to file their tax return online more conveniently.

Taxpayer Registration

By the help of PRA login, users can easily register themselves with PRA without the need for physical documentation and verifications.

Reduce Chances of Errors

As the PRA login is total systematic which helps the taxpayer in automatic tax calculations based on the information provided by taxpayer which ensures the accuracy.

Real-time Updates

Through PRA IRIS portal, taxpayers receive real-time updates and notifications regarding tax fiings and payments.

Benefits of PRA Login / PRA IRIS

Efficient

Using the PRA login portal reduces the time and effort for taxpayers while compliance with tax related matters.

Transparency

PRA login provides the accurate and up to date information to its users which helps in transparency.

Cost Savings

As compared to traditional/ manual tax filling PRA IRIS is cost effective and environmental friendly.

PRA Offices and Helplines

Punjab Revenue Authority works all over the province of Punjab with its head office located in Lahore. Following are the list of regional offices of PRA along with their helplines.

| City | Address | Helpline |

| Lahore – Head Office | Masion 5-B, Danepur Road, GOR-1, Lahore | 042-99205476-77, 042-99205481, 042-99205716 |

| Lahore | 2-1-B Aiwan-e-Tijarat Road, Lahore | 042-99205476-77 / 042-99205481 / 042-99205716 |

| Gujranwala | Gulshan-e-Aziz Colony Adjacent to Tevta Training Institute Near to Pindi bypass, Gujranwala | 055-9200914 / 055-9200916 |

| Faisalabad | 274 Khawaja Islam Rd, D-Ground, Block D People Colony No-1, Faisalabad | 041-9330549 |

| Rawalpindi | 276-A, Main Peshawar Road, Saddar, Rawalpindi | 051-9334011 |

| Multan | 116-C, Wapda Town, Main Block C, Near Phase 01, Main Northern By-pass Road, Multan | 061-9330303-07 |

| Rahim Yar Khan | 139 Canal Avenue, Abbasia Town Main Road, Rahim Yar Khan | 068-9330003 |

| Sialkot | 9th Floor Office#11 Mall of Sialkot, Cantt. | 052-4292385 |

| Sargodha | 01 PAF Road, Near Govt College of Technology, Sargodha | 048-9230730 |

| Gujrat | Seth House, Butt Street, Near GFC Fan, GT Road, Gujrat | |

| Bahawalpur | House #66-A Muhammadia Colony, Noor Mahal Road, Bahawalpur | |

| Sahiwal | House #15-A/1, Near MC High School, Farid Town, Sahiwal | 040-9200074 |

Conclusion

Punjab Revenue Authority IRIS is a significant milestone in the evolution of tax administration in Punjab. By integrating technology and innovation, PRA IRIS has streamlined the tax processes, promoting efficiency, transparency and compliance.

FAQ

1. For NTN verification online, go to FBR website

2. And from left menu click on “Taxpayer Profile Inquiry”.

3. Then select parameter type “NTN/CNIC or Passport No”

4. Now enter your selected parameter detail and enter the Captcha code and press “Verify”.

PRA stands for Punjab Revenue Authority, a governmental body to look after the tax related matters in Punjab, Pakistan.

For PRA login go to PRA website.

Enter your Registration no and Password.

Now click on Login.

Every Individual, Association of Persons or Company providing taxable services in Punjab is liable to register with PRA (Punjab Revenue Authority)