Pakistan Telecommunication Company Limited (PTCL) is a leading telecommunications service provider in Pakistan. PTCL plays an important role in the communication sector of Pakistan. PTCL offers wide range of services to its users which include landline telephone, broadband internet, TV, cloud pay and value-added services. And PTCL charge advance tax on its services against which PTCL issues a PTCL tax certificate. If you want to obtain your PTCL tax certificate then you are on the right place, in this article we will discuss each and every aspect of PTCL withholding tax.

Contents

What is PTCL Tax Certificates?

Under the section 236 of Income Tax Ordinance 2001, telephone and internet service providers including PTCL are required to collect Advance Income Tax from the customers on all billings and receipts. After the collection of advance income tax, PTCL submit the advance tax to FBR against the NTN of the customer and issues an income tax certificate to its customer which shows the following.

- Date of Issue

- Total amount of income tax collected

- Name and Address of customer

- NTN (National Tax Number) of customer

- Telephone/Mobile Number against which income tax is collected

- Financial period of the tax

PTCL, Pakistan’s leading telecommunications company, provides tax certificates to its customers. These documents help in claiming tax refunds and managing tax liabilities efficiently.

Importance of PTCL Withholding Tax certificates

PTCL tax certificates serve multiple purposes. They verify the taxes you’ve paid, which is vital during tax filing season. Withholding Tax certificates are essential for verifying tax deductions and facilitating transparent financial transactions. Tax certificates are essential for both individuals and businesses for tax compliance, tax return submission purposes as well as availing income tax deductions.

Tax paid under Section 236 can be claimed and adjusted in the annual income tax return, which can reduce income tax liability or increase the income tax refund from the Federal Board of Revenue (FBR).

Exemption from Withholding Advance Tax

As per the section 236(4) of Income Tax Ordinance 2001, advance tax shall not be collected from Government, foreign diplomat, diplomatic mission in Pakistan, or a person who submit the certificate issued from Commissioner that his income during the tax year is exempted from tax.

If the customer falls under Section 236(4) of the ITO, he must submit the required documents to a PTCL representative to exclude withholding advance tax from billing.

Rates of PTCL Withholding Advance Tax

Following rate of withholding tax is applicable on PTCL products and services in Pakistan based on the location of the customer.

| Product/Service | ICT, Punjab, KPK, Sindh & AJK | FATA/PATA |

| Landline Telephone | 10% exceeding Rs.1,000/- per month | 0% |

| Internet Services | 15% | 0% |

| TV, VOD and Video Streaming | Not Applicable | Not Applicable |

| Value Added Services | Not Applicable | Not Applicable |

| Equipment and Devices | Not Applicable | Not Applicable |

Download PTCL Tax Certificates

You can download PTCL tax certificates by logging in to the PTCL customer portal or by visiting a PTCL sales and service center.

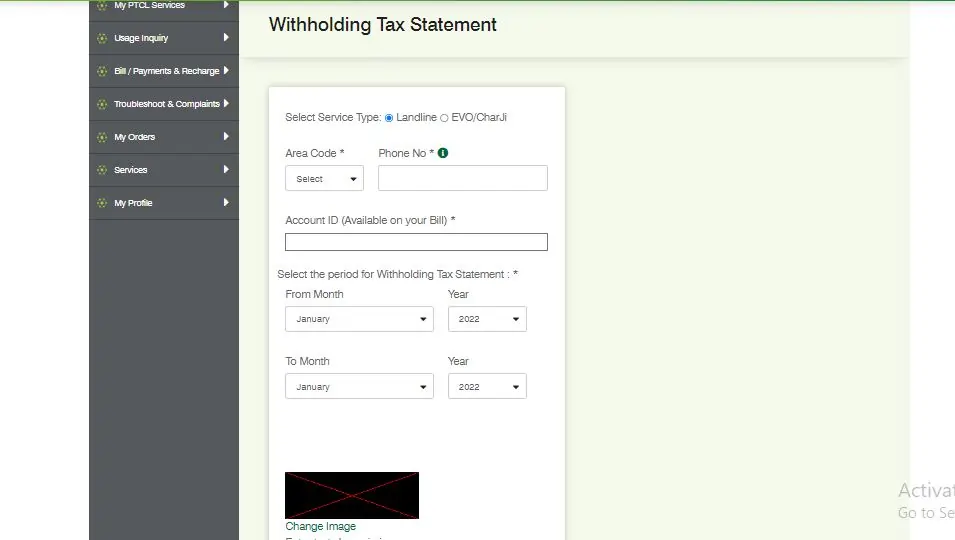

To obtain PTCL withholding tax certificate, follow below mentioned procedure.

- Visit official website of PTCL of click here.

- Now select your service type that is Landline or EVO/Charji

- Enter your “Area Code” and type your “Phone No.”

- In “Account ID” field, type your account ID mentioned on your monthly bill or invoice.

- Select the period for which you want to download tax certificate. Financial period usually starts from July to June.

- In the Captcha field, enter the text shown in the image.

- Finally, click on “Inquire Tax”.

FAQ

1. Visit official website of PTCL or click here.

2. Select your service type from service type field

3. Select the code of your area and enter the phone number.

4. Now select the financial period, and click on “Inquire Tax”.

In ICT, Punjab, KPK, AJK and Sindh province, advance tax on landline telephone is 10% exceeding Rs.1,000 per month, and advance tax on internet services is 15%. Where as in FATA and PATA 0% tax is applicable on landline telephone and internet services.

Under Section 236(4) of the Income Tax Ordinance (ITO), the government, foreign diplomats, and individuals who provide a certificate from the Commissioner confirming their income is exempt from tax during the year do not have to withhold advance tax.

Conclusion

Obtaining your PTCL tax certificate is simple and straightforward process that ensures that you have accurate and complete records for tax filing and refunds. Follow the step outlined in this article to access your withholding certificates effortlessly.