SRB stands for Sindh Revenue Board, established through Sindh Revenue Board Act, 2010. Sindh Revenue Board is primarily responsible for collection of sales tax on services provided in Sindh, Workers Welfare Fund in Sindh and Sindh Workers Profits Participation Fund. SRB has offices in major cities of Sindh province like Karachi, Mirpurkhas, Hyderabad, Larkana, Shaheed Benazirabad and Sukkur with more than 300 employees. SRB implemented online login portal to manage the sales tax more accurately.

Contents

- 1 Functions of SRB

- 2 History of Sindh Revenue Board and Sales Tax

- 3 History of Labor Welfare Laws in Sindh

- 4 Taxable Services under SRB

- 5 Organizational Structure of SRB – Organogram

- 6 Performance of SRB

- 7 SRB Portal / SRB Login

- 8 How to e-Register with SRB?

- 9 How to Login to SRB?

- 10 SRB Online Verification

- 11 Conclusion

- 12 FAQs

Functions of SRB

The main objective of SRB is to increase the tax revenue within province of Sindh. Other functional areas of Sind Revenue Board are given below:

- Tax Policy Formation

- Registration of taxpayers

- Assessment of tax liabilities

- Recovery of tax amount

- Maintaining the taxpayer database

- Ensure tax compliance

- Promote tax awareness

- Implementation of Tax Laws

- Audit of the taxpayers

- Managing legal matters

- Regulation of Procedures

- Administration

- Human Resource within the SRB

- Facilitating the Taxpayers

- Collections of Sindh Workers Welfare Fund Contributions

- Collections of Sindh Companies Profit Workers Participation contributions

- Assist Government of Sindh in formation of economic policies for Sindh

History of Sindh Revenue Board and Sales Tax

The General Sales Tax Act of Pakistan, 1948, was implemented on April 1, 1948, making sales tax a federal levy. Later, this Act was repealed through the Sales Tax Act, 1951, which initially imposed sales tax only on the sale and use of goods, but later expanded its scope to include sales, income, output, production, manufacture, preparation, or disposal of goods.

The Goods (Sales and Purchase) Order, 1960, was introduced. The Sales Tax Act, 1990, replaced the 1951 Act and introduced the VAT model for levying taxes on goods. Due to not being included in the Federal Legislative List or the Concurrent Legislative List, services remained within the provincial domain for sales tax purposes. This position was further clarified through the Fifth Constitutional Amendment of 1976 and the 18th Constitutional Amendment of 2010 (referring to item number 49 of Part A of the Fourth Schedule of the Constitution of Pakistan, 1973).

The Sales Tax Ordinances of 2000, which included the Sindh Sales Tax Ordinance, 2000, were issued by the Provinces and became effective from July 1, 2000. These ordinances authorized the Federal Board of Revenue to collect Provincial Sales Tax on Services. At the same time, the imposition of Central Excise Duty (now Federal Excise Duty) on services taxed by the provinces was withdrawn.

The Sindh Sales Tax on Services Act, 2011, was passed by the Sindh Government and became effective from July 1, 2011. This act-imposed Sindh Sales Tax (SST) in accordance with Articles 8 and 9(2) of the Seventh NFC Award of 2010.

After the passing of 18th Amendment of the Constitution like Sindh, Punjab also established its own revenue authority called Punjab Revenue Authority (PRA), Khyber Pakhtunkhwa also established its Khyber Pakhtunkhwa Revenue Authority

History of Labor Welfare Laws in Sindh

After the passing of 18th Constitutional Amendment in 2010, matters pertaining to labor welfare were also passed to provinces. Keeping in view of this in 2014, Government of Sindh enacted Sindh Workers Welfare Fund Act 2014 for the collection of SWWF within Sindh form eligible industrial organizations. Subsequently, in 2015 Sindh Companies Profit Act 2015 was passed for the collection of contributions.

Under the section 8 of the Sindh Workers Welfare Fund Act, contributions collected from eligible organizations to be invested in establishing the housing estates, educational institutions, hospitals, construction of houses and apartments for workers and their dependents.

Taxable Services under SRB

In the 2nd Schedule of Sindh Sales Tax on Services Act 2011, list of taxable services is mentioned. Taxpayers under Sindh region are advised to review the 2nd schedule and get registration done with SRB in case their organization falls in the scope of the list. General rate of sales tax on services in Sindh is 13% with the exception of telecommunication services which are taxed at 19.5%.

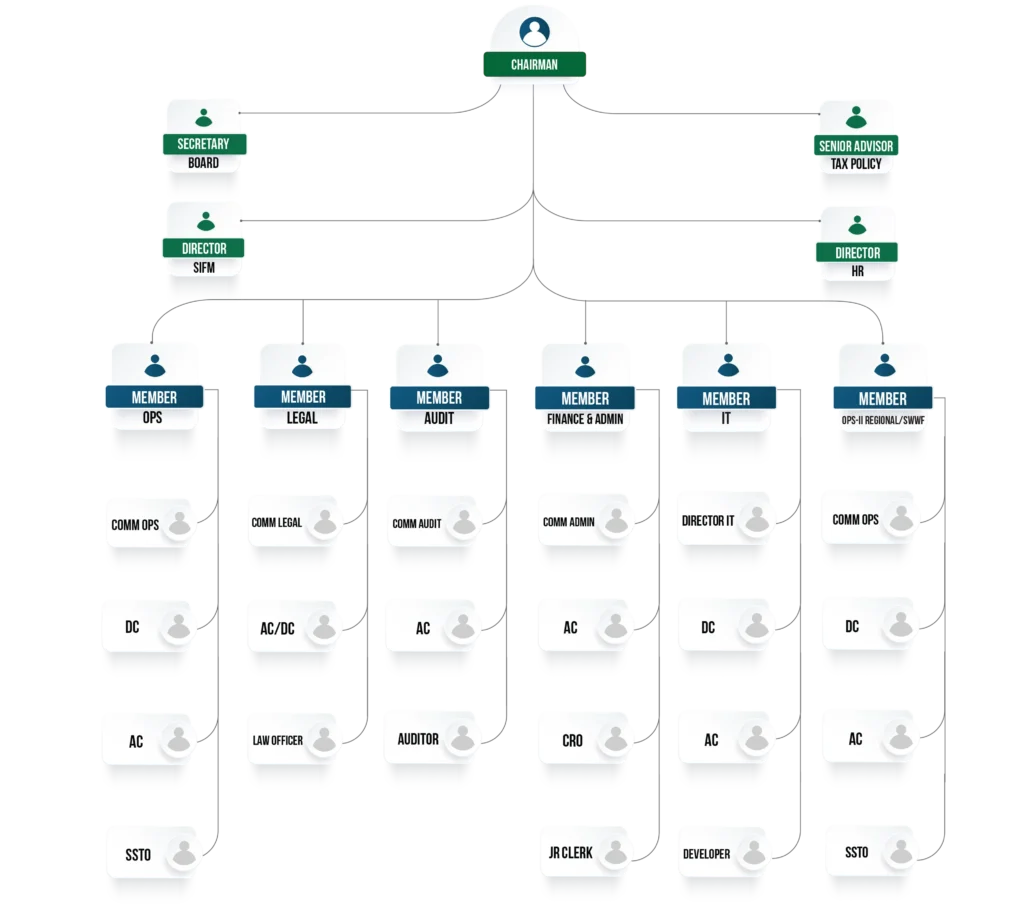

Organizational Structure of SRB – Organogram

SRB Chairman is responsible for heading the SRB Board along with Senior Advisor Tax and four Members. These four members include Senior Member (Operations), Senior Member (IT & Audit), Member Operations II and Member (Admin, Finance, Accounts & Coord). These Members look after the guidelines formulation and managing the matters pertaining to functional part of SRB. Chairman, Senior Advisor Tax Policy, Secretary Finance and Members attend the regular Board meetings. Organogram of SRB is given below.

Performance of SRB

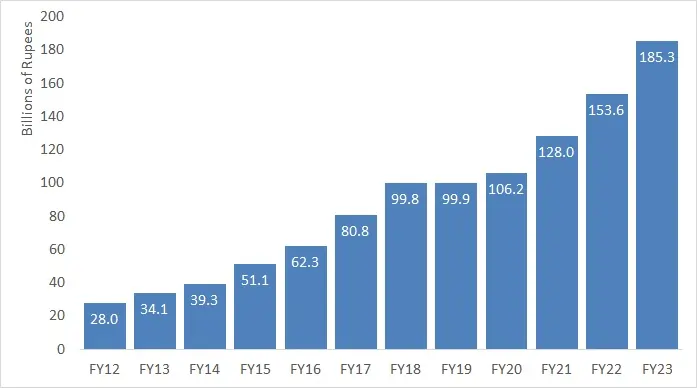

SRB is a significant source of revenue for the Government of Sindh and has consistently emerged as a major revenue contributor for the Government o Sindh. Starting from Rs.28 billion in FY 2011-12, the SRB’s revenue collection has steadily increased, as illustrated in the chart below. In FY 2022-23, the SRB achieved an impressive revenue collection of Rs.185.3 billion.

Major Sectors of SRB

| Sr. No. | Major Sectors | Growth in FY 2022-23 |

| 1 | Terminal Oprators, Port and Airport | 15% |

| 2 | Telecommunication | 2% |

| 3 | Franchise | 5% |

| 4 | Bank | 17% |

| 5 | Insurance | 17% |

| 6 | Contract Execution | 25% |

| 7 | Construction | 8% |

| 8 | Goods Transportation | 33% |

| 9 | Restaurants | 50% |

| 10 | Scientific, Technical & Engineering Consultants | 24% |

SRB Portal / SRB Login

All the provincial revenue authorities along with FBR and World Bank, Single sales tax return portal was established. This will help the taxpayers across the Pakistan to file a sales tax return to multiple jurisdiction through one window. This system was designed to facilitate the taxpayers in doing business and reducing the cost of compliance. By using this e-SRB Login portal taxpayer can file the tax return very easily. The new sales tax login e-portal will minimize the need for manual data entry, address common data issues and calculation errors. Additionally, it will automate the handling and distribution of input tax adjustments and tax payments among various sales tax authorities, thereby reducing the need for reconciliations and payment transfers.

To oversee tax policy, tax administration and facilitation, processes such as registration, enrollment, tax payment, and return filing for Sindh sales tax on services are conducted electronically. An in-house database is utilized for assessment, audit, tax monitoring, coordination, and verifications. SRB has implemented the Oracle Business Intelligence Tool to report and manage tax payments, enhancing the administration’s ability to analyze historical data, identify trends, and make informed decisions regarding tax policy and resource allocation.

How to e-Register with SRB?

If you fall under the region of Sindh and want to register yourself at eSRB portal then follow the step by step below mentioned procedure.

- Go to official website of eSRB i.e. e.srb.gos.pk

- Now from the top header click on the “e-Registration” option.

- After that click on “New e-Registration“. Next tab with Taxpayer Registration Application will open.

- Enter your NTN (if you are already registered with FBR)

- System will automatically fetch your record from FBR database and display in respective fields.

- Enter the Captcha code from Image and click “OK”.

- A Taxpayer Registration Form will open. Form will show pre-filled your particulars as recorded in FBR.

- In the first section of Registry, enter your registration particulars, i.e. Name, Registration date, Address, Province, District, type of services.

- In Agent Particulars u/s 67 enter details of your representative such as NTN/CNIC, Name, Address, Phone and Email.

- Now save the Registry to move to the next section.

- Now provide the particulars of Directors/ Shareholder such as NTN/CNIC and total capital.

- In the next section if you have other activity than principal activity please give details.

- In Business/Branches section if you operate from more than one location through branches or outlets, provide the details of all of them.

- In Bank Account section, enter the details of your bank account which include A/C no., A/C title, Account Type, Bank, City, Branch, account opening date.

- In Declaration section you will confirm that information given is correct and complete.

- Now Save the form and click on Verify Application.

- Enter required information in pop up verification window.

- Now click on “Submit Application”

- After successful submission of registration form, you will receive the user Login ID and Password on your email and mobile.

Registration without NTN

If you want to register with SRB login portal but don’t have NTN then SRB will provide you with a Provisional Registration Certificate, valid for thirty days or until you receive your NTN from FBR.

During your provisional registration period, you will have access to all SRB login facilities available to other taxpayers with NTN.

If your NTN is not issued within thirty days, your registration with SRB will be cancelled, and you will be notified via email.

How to Login to SRB?

If you have enrolled with SRB login portal, and wants to e-File your sales tax on services return then follow the below mentioned procedure.

- Go to SRB login portal or click here.

- In the User ID field enter your NTN.

- In the Password field enter your password.

- After that click on Login button to get access to eSRB login portal.

SRB Online Verification

If you want to verify the tax status of a taxpayer then follow below mentioned procedure.

- Go to eSRB official website

- From the top header click on the “Search Taxpayer”

- Choose the Search Parameter i.e. SNTN, CNIC or Passport no.

- Now enter the parameter in next field and click on “Search” button.

- System will process your request and display the status of taxpayer.

Conclusion

Sindh Revenue Board (SRB) is the backbone of revenue collection system in Sindh. SRB serves as a cornerstone of economic development in the province of Sindh. Sindh Revenue Board implemented online portal to efficiently manage the tax matters and to facilitate the taxpayers. SRB shows a potential revenue growth over the years.

FAQs

General sales tax on services in Sindh is taxed at 13% with exception to telecommunication which is taxed at 19%.

Go to ntnverification.pk

Scroll down till you see the option “NTN Verification”, click on that new window will open.

Now choose the Parameter type.

Enter your NTN or CNIC number.

Enter the Captcha Code and click on Verify.

To individuals, 13 digits CNIC is considered as NTN number where as to AOP and Companies 7 digits NTN number is issued.