PSID stands for Payment Slip Identifier, basically you cannot pay any tax to FBR unless you have the PSID with you. Payment Slip ID refers to the number which is linked to the tax you are about to pay against your NTN of CNIC number. PSID is consists of unique numbers generated through online portal. Before making that payment, you will have to generate PSID from your FBR portal. PSID is used to pay taxes or dues to Government of Pakistan.

Contents

When PSID is Required?

When taxpayer wants to make the payment to Government of Pakistan via E-Payment, PSID number will be generated to make this payment. For multiple number of payments, portal will generate separate PSID payment slip for each transaction. PSID is also required when registering PTA mobile device and Payment of PTA Tax.

Also Read:

How to do NTN verification Online by CNIC?

What is Active Taxpayer List (ATL)?

How to generate PSID challan?

Generating PSID slip for payment purposes is simple and easy follow the below mentioned steps:

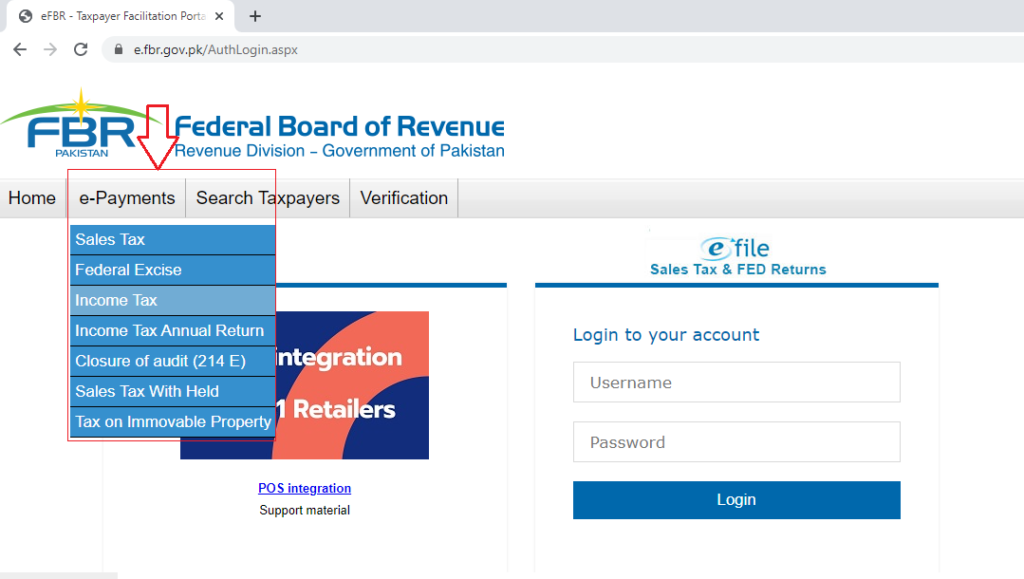

- Before payment of any tax you must login to E-File portal of FBR

- To access the E-File portal, Go to official website of FBR or Click here https://e.fbr.gov.pk/authlogin.aspx

- Now login to E-file using the same username and password used to login to IRIS portal.

- After logging in to E-File, go to the option e-Payments.

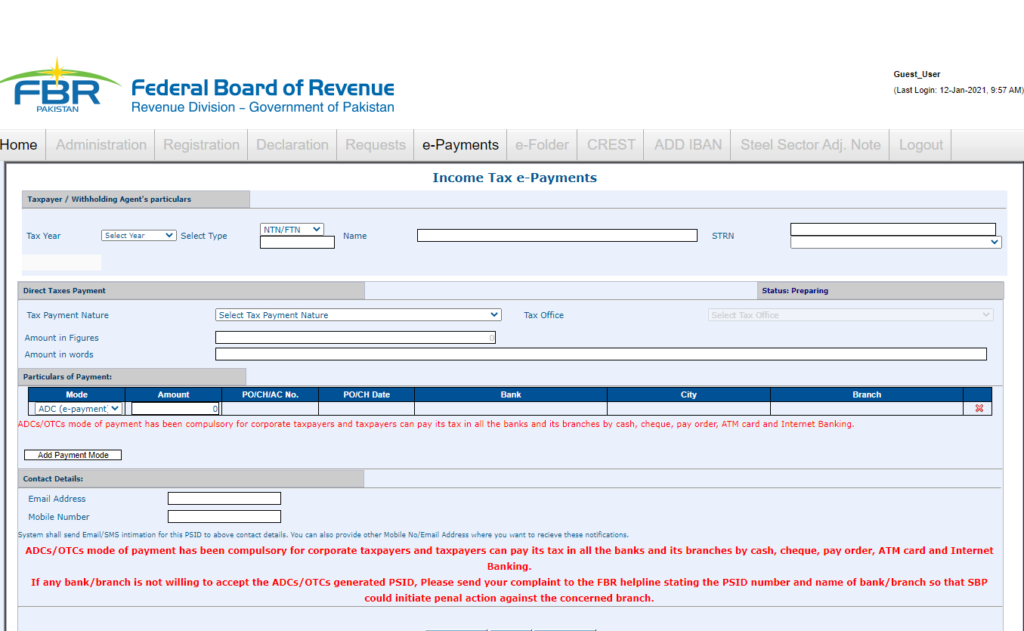

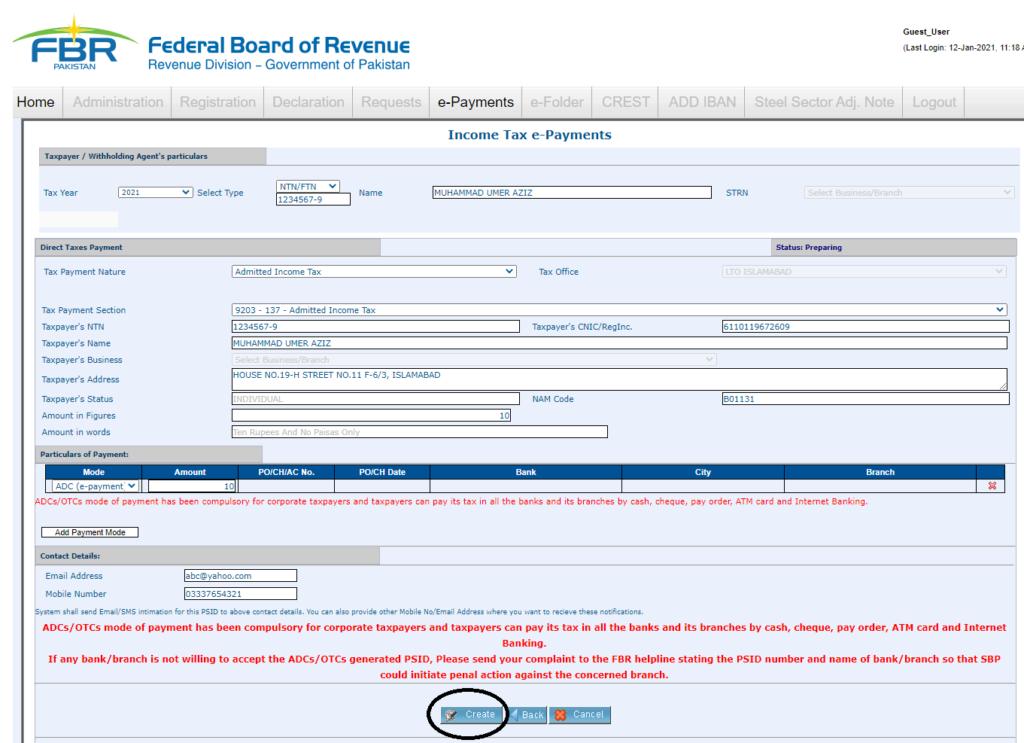

- From that select the Tax Year.

- Select Type such as CNIC, NTN. After entering the NTN number, Name of that user will appear in Name field. You can verify the user.

- Next go to “Tax Payment Nature” and select the nature of your tax you want to pay.

- Now enter the Amount in Figure and Amount in words.

- And in contact details type your email address and mobile number.

- Now click on “Create”.

- Now system will ask you the city in which you want to make payment, select your desired city and click on Print button.

- Your PSID payment slip or PSID payment challan will downloaded into you PC.

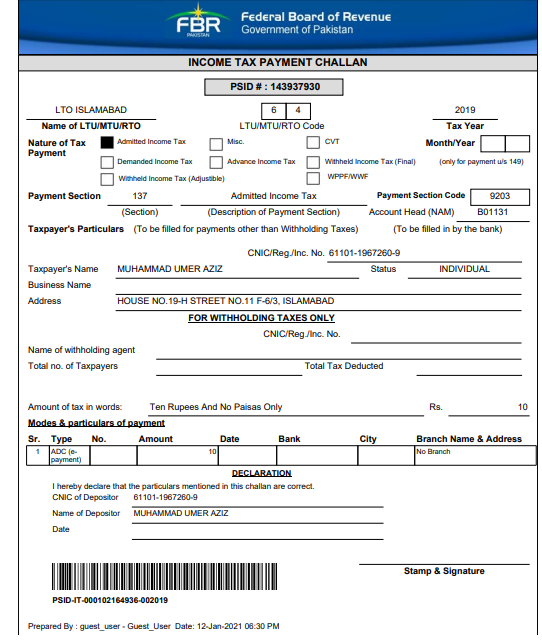

Elements of PSID

After generating the PSID payment slip, you can cross the following information given on PSID is correct or not:

- PSID Number

- Name of LTU/MTU/RTO

- LTU/MTU/RTO Code

- Tax Year

- Nature of Tax Payment

- Month/Year

- Payment Section

- Payment Section Code

- Taxpayer’s Name

- CNIC of Taxpayer

- Status of Taxpayer

- Business Name

- Address of business

- Amount of tax in figures and words

- Mode & particulars of payment

How to pay PSID payment slip?

You can pay the PSID by visiting the nearest branch of commercial bank.

If you want to pay PSID payment online, follow the procedure:

- Go to your bank website and login to your account

- Now look for the option of “Payments”

- From Bill payee type click on “tax payment”

- In Bill payee name type “FBR/PRA”

- Now type your PSID number.

- System will process your PSID number will display the result.

- Verify the details from PSID. And press next.

- Agree to the term and conditions

- Provide the OTP and email PIN for completion of PSID payment

- You have completed your PSID payment.

Conclusion

In final words, Federal Board of Revenue established a convenient method for taxpayer to pay their tax without any difficulty. By the use of mobile or laptop taxpayer can easily generate the PSID from e-file portal and can make payment to FBR within no time.