Contents

- 1 Introduction

- 2 How to Verify National Tax Number

- 3 Types of National Tax Number

- 4 Online NTN Inquiry

- 5 Benefits of NTN Inquiry

- 6 How to change National Tax Number

- 7 Who should register with FBR?

- 8 How to Register with FBR for NTN?

- 9 Required Documents for FBR NTN registration in case of Salaried Persons

- 10 Documents required for FBR NTN Registration in case of Business (Sole Proprietorship)

- 11 Documents required for FBR NTN Registration in case of AOP and Companies

- 12 NTN Registration Step by Step Guide

- 13 Benefits of NTN Registration

- 14 Conclusion

- 15 FAQ

Introduction

Federal board of revenue (FBR) has designed a system which serves as a mean for verifying the tax registration status of individual, AOP, Companies and any other entity registered in Pakistan. The National Database and Registration Authority (NADRA) in collaboration with the Federal Board of Revenue (FBR) oversees the NTN verification process in Pakistan.

To ensure legal compliance with tax regulation in Pakistan, FBR verification of National Tax Number is most important part for individuals and businesses operating with in Pakistan. Online NTN verification provides the assurance regarding the accuracy of tax related information provided by individuals and businesses.

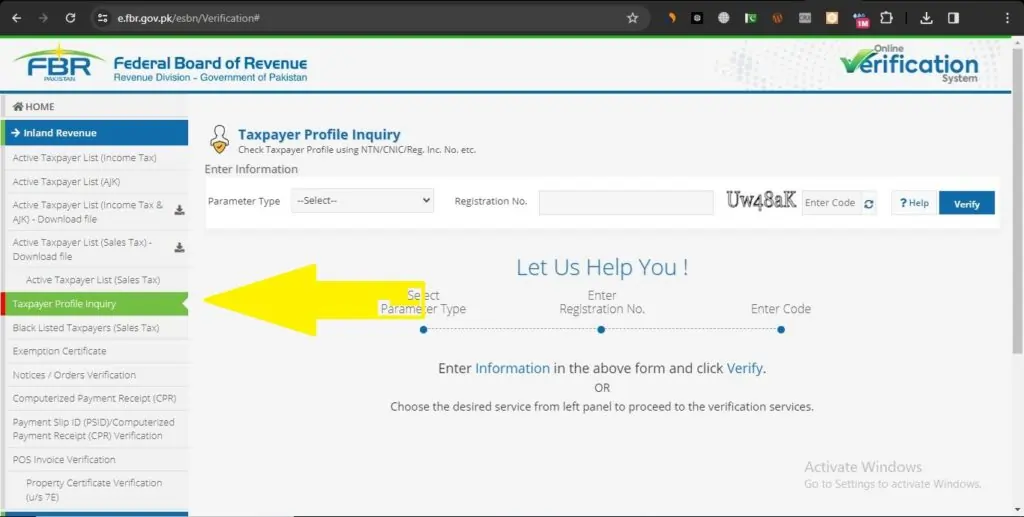

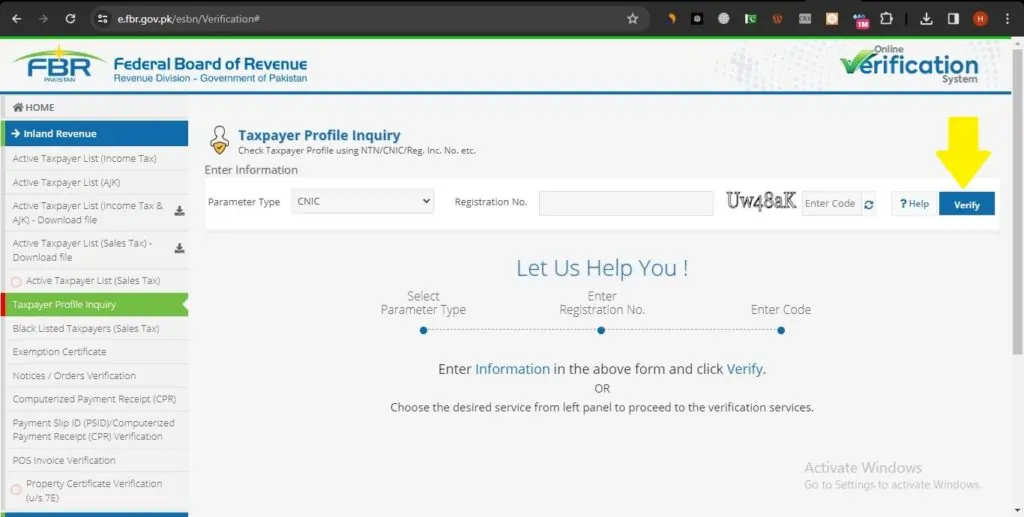

Tax Profile Inquiry

How to Verify National Tax Number

For NTN inquiry go to FBR website, and follow the following instructions:

- After opening the FBR website from the left corner, select “Taxpayer Profile Inquiry“.

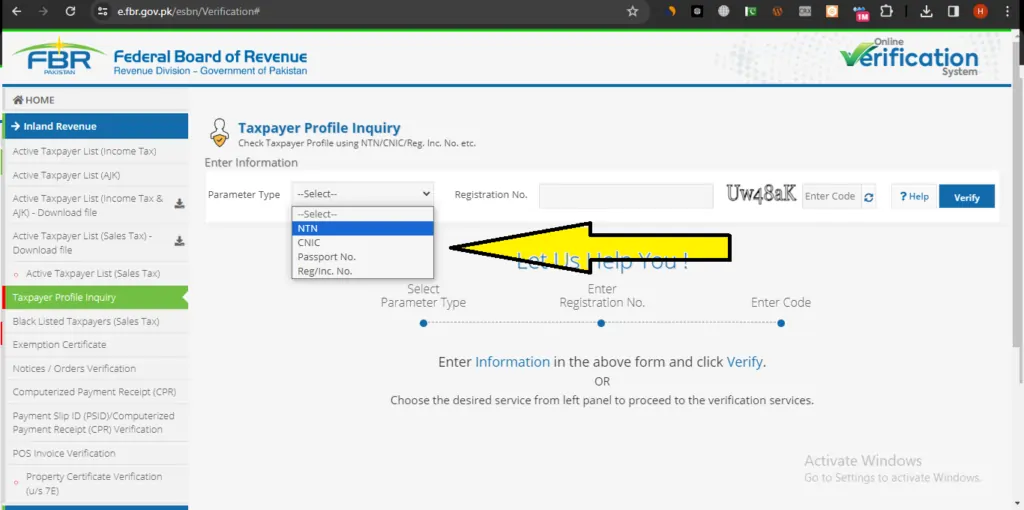

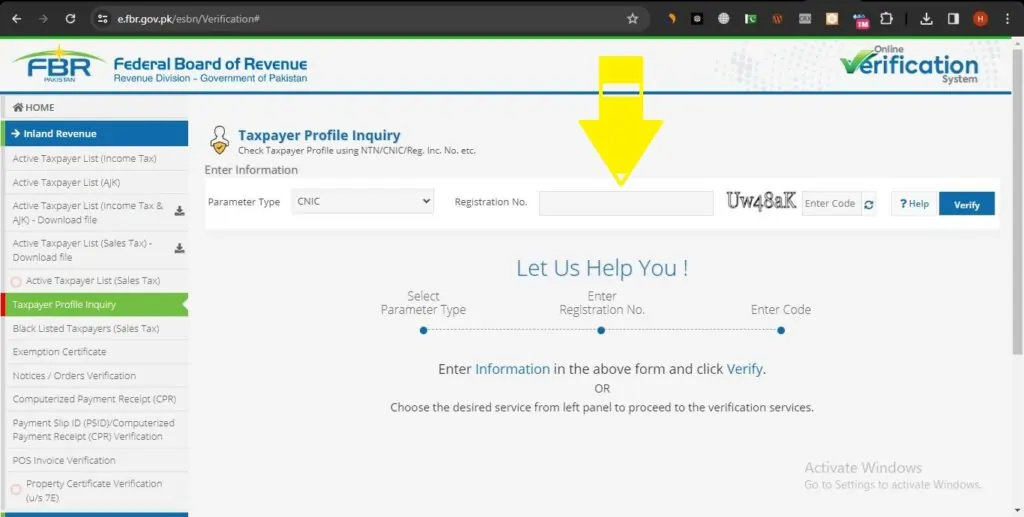

- Now form Parameter Type, select you desired input type i.e. CNIC, NTN, Passport No or Reg/Inc No.

- Now in registration No. field enter your NTN number.

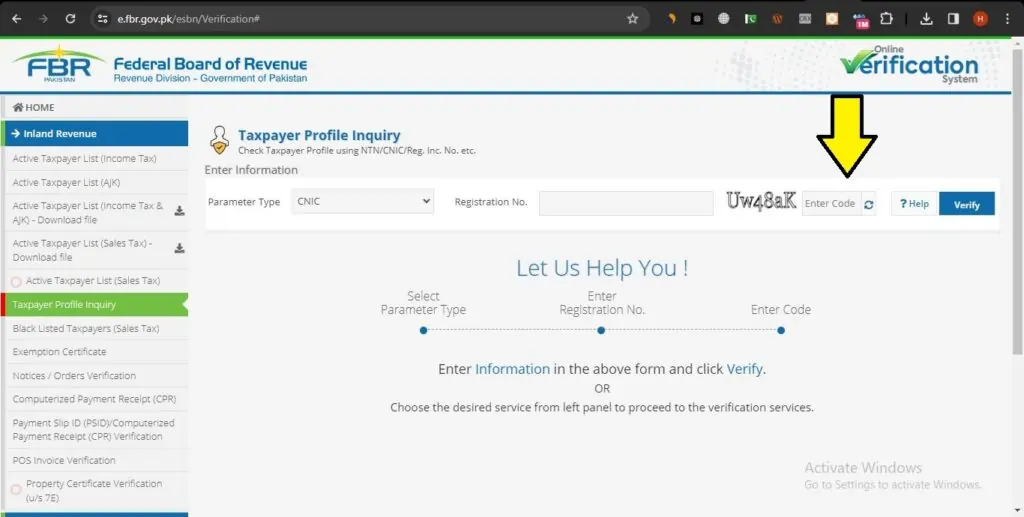

- In Captcha field enter code.

- Carefully read all your input details and click Verify button.

Types of National Tax Number

There are three types of online NTN in Pakistan:

1. Personal NTN:

FBR issues this type of NTN on the CNIC of the person to both salaries and business individuals. FBR NTN inquiry can be done via FBR online portal system. Moreover, after FBR profile registration, the taxpayer may add Sole proprietor business separately.

2. Association of Persons (AOP) / Partnership NTN:

This kind of online NTN is provided to the association of persons. At least two partners form the AOP. You can check it by online NTN Inquiry.

3. Company’s NTN:

At the time of company registration SECP issue registration/incorporation number to company which can be used to check company NTN on FBR portal.

Online NTN Inquiry

Most of the people wonder and ask about how to inquire tax status online and find it quite difficult but no need to worry because we bring you the complete guide for this. In today’s world online services provide the ease to the users, same like this online NTN inquiry provide the ease to individual and businesses in verifying tax status for accurate tax compliances.

Moreover, NTN verification can also be done through designated bank branches or agents. But online process is more convenient and accessible.

How to verify NTN Online??

Online NTN Verification by CNIC

FBR provides the facility to individuals for online NTN inquiry by CNIC via web portal. Follow below mentioned steps:

- Go to the e-portal of the FBR’s site “https://e.fbr.gov.pk”.

- Select “Taxpayer Profile Inquiry” from the left menu bar.

- To verify your individual’s NTN. Select ‘NTN’ or ‘CNIC’ from the “Parameter Type” section. If you are a foreigner then select “Passport No” from the “Parameter type” section. A company or Incorporation’s NTN can be checked by selecting the “Comp/Reg No” from the “Parameter type” section.

- Type your 13 digits CNIC number in the “Registration No”.

- Enter displayed Captcha in “Enter Code” field.

- Now click “Verify” and your tax information will be displayed.

NTN Verification through SMS

- For Individual Active Taxpayer: Type “ATL (space) 13 digits “CNIC number” and send it to 9966.

- For AOP and Company: Type “ATL (space) 7 digits NTN number” and send it to 9966.

NTN Verification Charges

There are no charges for online verification however service providers may charge nominal fee for verification through SMS.

Benefits of NTN Inquiry

You must be thinking that why bother with NTN verification, well think of it as you tax ID health checkup. Tax payer inquiry offers multiple benefits to individuals and businesses such as

- More transparent financial transactions

- It ensures your tax related matters are in order

- It helps to avoid legal proceeding in future due to non-compliance

- Compliance with legal and tax requirements

- Access to financial opportunities like credit facilities and business opportunity

- Facilitation to various financial services

How to change National Tax Number

If individual of business individual wants to amend NTN then follow the below mentioned steps:

Individual Change

- Login to IRIS FBR portal

- Click on Registration from menu bar

- Now, from extreme left click on 81 (Form of Registration filed for modification)

- Now amend the form as per your requirements

Company/AOP Change

If Company/AOP is not registered for sales tax only than they can amend NTN by following below mentioned procedure.

- Login to IRIS FBR portal

- Click on Registration from menu bar

- Now, from extreme left click on 81 (Form of Registration filed for modification)

- Now amend the form as per your requirements

Following documents are required for amendments in NTN

- Form 21 and Lease agreement incase of change of address of company

- Profit sharing ration in case of change in partnership structure

- And for any other material change, updated partnership will be require.

Company/AOP registered for sales tax need to visit Regional Tax Office for amendments.

Check out the Salary Tax Calculator for Financial Year 2023-24

Who should register with FBR?

As Section 114(1) of ITO 2001 provides for compulsory registration of persons with FBR. ITO 2001 defines the persons who must obtain NTN as mentioned below:

- Each individual business

- Every company

- Every AOP

- Every Association/NGO/NPO

- A salaried person having an annual income of PKR 600,000/- or more.

- Every professional registered with an association, council or other registering authority like engineer, doctor, lawyer etc.

- Owner of a vehicle of 1000cc or above

- Also owner of 5 Marla flat or house.

- others

How to Register with FBR for NTN?

Nowadays FBR has made the enrolment cycle very accessible for anyone who is trying to register with FBR. After that it will not be mandatory to appear in person at FBR. The process of getting NTN has become exceptionally easy.

To obtain your NTN from FBR, follow the below mentioned procedure:

- Open FBR IRIS portal

- Now click on the E-enrolment button.

- Enter your personal legal details as required.

- And click the submit option that appears at the end.

- After submitting the information, you will receive a password to access your FBR IRIS account. In Draft, you will already have Form 181 available.

In the form input your personal data including bank and property details. Submit a completed form and your NTN will be registered in moments. It is important to enter all the required information carefully as per the recent amendments in the tax laws incomplete forms may result in FBR penalty.

Required Documents for FBR NTN registration in case of Salaried Persons

- CNIC, NICOP or Passport number

- Cell phone number

- Active e-mail address

- Nationality

- Residential address

Documents required for FBR NTN Registration in case of Business (Sole Proprietorship)

- Copy of CNIC.

- A copy of the business’s most recently paid electricity bill.

- Copy of rental agreement or ownership documents

- Mobile and email address.

- Nature of business

- Stamped on letterhead.

- Any other document as required by FBR.

Documents required for FBR NTN Registration in case of AOP and Companies

- Name of Company or AOP

- Business name

- Business address

- Accounting period

- Business phone number

- Email address

- Cell phone number of the principal officers of the company or AOP

- Principal business activity

- Address of principal place of industrial establishment or business

- Type of company, like Public Limited, Private Limited, Unit Trust, Trust, NGO, Society, Small Company, Mudarabah or any other

- Date of registration

- Incorporation certificate from Securities and Exchange Commission of Pakistan (SECP) in case of company

- Registration certificate and partnership deed in case of registered firm

- Partnership Deed if the firm is not registered

- Trust deed in case of trust

- Registration certificate in case of society

- Name of representative with his CNIC or NTN

- Following are the details of each director and major shareholder holding 10% or more shares in the company or partners in case of AOP,

- Name

- CNIC/NTN/Passport and

- Share %

NTN Registration Step by Step Guide

How to open IRIS

- Click on the following link on your computer’s Internet browser: https://iris.fbr.gov.pk/infosys/public/txplogin.xhtml

- You will see this screen.

- Click on “Registration for Unregistered Person” link.

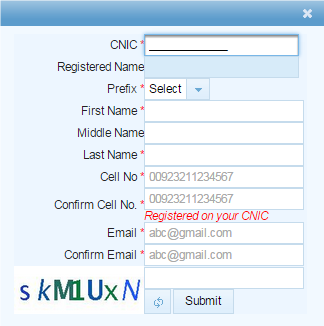

Enrolment of Basic Information

- Fields marked with “*” are mandatory.

- Enter your National Identity Card number without “-” in the “CNIC” field.

- Enter your full name without “Prefix” in the “Registered Name” field as listed on your National Identity Card.

- Select the corresponding value in the “Prefix” field.

- Enter your personal name in the “First Name” field.

- Enter your father’s name in the “Middle Name” field.

- Enter your name in the “Last Name” field.

- Enter your mobile number in the “Cell No” field.

- Re-enter the same mobile number in the “Confirm Cell No” field. Your mobile number must be registered in your name at least 1 day before.

- Enter your email in the “Email” field.

- Enter your same email again in the “Confirm Email” field.

- Enter the characters given in the image in the next field. If you have trouble reading the letters, click on the button to read the letters again.

- Click on “Submit” button. The system will send 5 different codes to the registered mobile number and email.

- Click “Resend” if codes are not received within 0 to 2 minutes.

- Enter the code received on the mobile in the “SMS Code” field.

- Enter the code received on the email in the “Email Code” field.

- Click on “Submit” button.

- Now your account will be created on FBR Iris and your password will be received to you on your mobile and email within 0 to 2 minutes.

How to Login to FBR IRIS

- Click on the following link on your computer’s Internet browser: https://iris.fbr.gov.pk/infosys/public/txplogin.xhtml

- You will see this screen.

- In the field of “Registration No.” enter your National Identity Card number without “-“.

- In the “Password” field, enter your mobile or email password. Enter case sensitive.

- Click on “Login” button.

- In case of incorrect registration number or password. “Invalid Registration No. or Password” message will be received.

- If the registration number and password are correct this screen will appear. and you are successfully logged in to FBR IRIS.

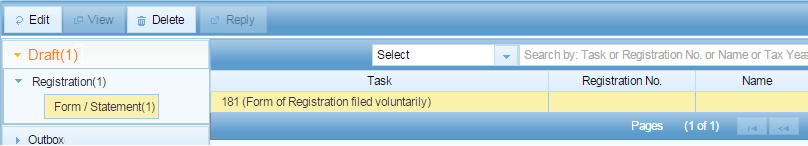

How to Register

- Click on “Draft” in the left panel of the screen.

- Then click on “Registration”.

- Then click on “Form / Statement”.

- Then in the middle panel of the screen Click on “181 (Form of Registration filed voluntarily)”. This field will be highlighted and the “Edit” button will turn on.

- Click on “Edit” button.

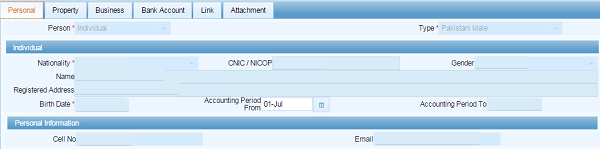

Personal Information Enrollment

- Click on “Personal” tab.

- You will see this screen.

- Select the relevant value in the “Accounting Period From” field.

Address Enrolment

- Registration of residence or head office address is mandatory.

- For this click on “Property” tab.

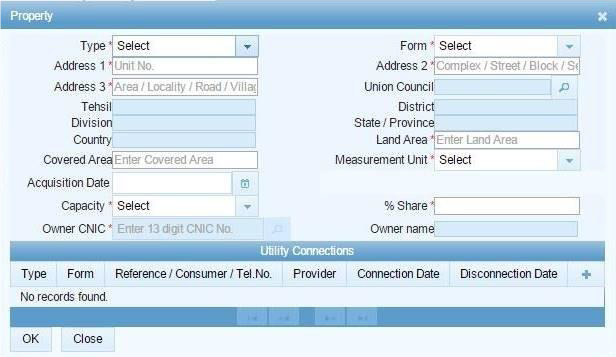

- You will see this screen.

- Click the button on the right in the “Properties” section.

- The “Property” dialog box will open.

- Fields marked with “*” are mandatory.

- Select the corresponding value in the “Type” field.

- Select the corresponding value in the “Form” field.

- Enter the unit number in the “Address 1” field.

- Enter Complex/Street/Block/Sector in “Address 2” field.

- Enter area/road/village in “Address 3” field.

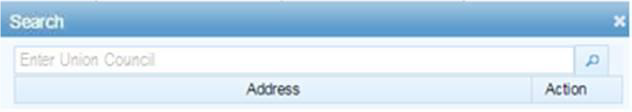

- Click on the button ““opposite “Union Council”.

- The “Search” dialog box will open.

- Enter the name of the concerned Union Council in the field and click on the button in front.

- The list of one or more union councils will appear in the table below.

- Click on the “Select” to select the concerned Union Council. The dialog box will close and the selected union council will be transferred to the field of “Union Council”.

- “Tehsil”, “District”, “Division”, “State/Province”, “Country” will be displayed based on the selected Union Council.

- Enter the corresponding value in the “Land Area” field.

- Enter the corresponding value in the “Covered Area” field.

- Select the corresponding value in the “Measurement Unit” field.

- Click on “Acquisition Date” to select relevant date, month, year.

- Select the corresponding value in the “Capacity” field.

- Enter “% Share” without the % sign.

- In the “Owner CNIC” field, Enter the national identity card number of the owner of the house. Click on the button on the front.

- The name of the house owner will appear in the relevant field.

- Click “OK” on the “Property” dialog box after providing the information.

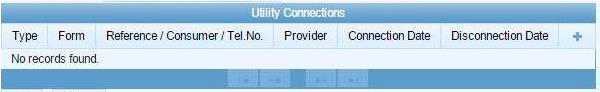

- To provide details of utility connections connected to the property, click the button “+”on the right corner in the “Utility Connections” section.

- The “Utility Connection” dialog box will open.

- Fields marked with “*” are mandatory.

- Select the corresponding value in the “Type” field.

- Select the corresponding value in the “Form” field.

- Enter the “Reference / Consumer No.” in the field.

- Select the relevant value in the “Provider” field.

- Click on “Connection Date” to select relevant date, month, year.

- Click on “OK” button after providing the information.

- For multiple utility connections repeat the same process as First utility connection.

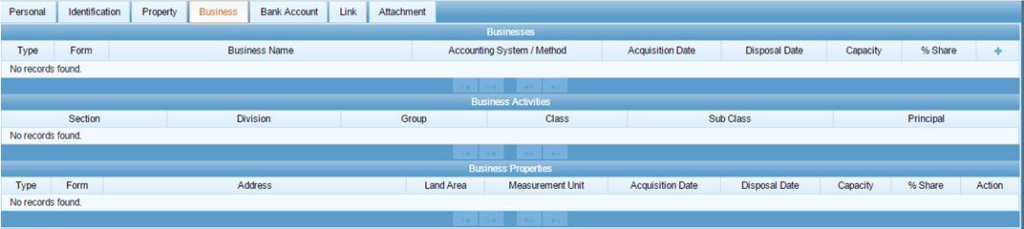

Business Enrolment

- Registration is mandatory if you run a business.

- For this click on “Business” tab.

- You will see this screen.

- In the “Businesses” section click on the button “+” on the right corner.

- The “Business” dialog box will open.

- Fields marked with “*” are mandatory.

- Write full business name without “M/S” in “Business Name” field

- Select the corresponding value in the “Type” field.

- Select the corresponding value in the “Form” field.

- Select the relevant value in the “Accounting System / Method” field

- Click on “Acquisition Date” to select relevant date, month, year.

- Select the corresponding value in the “Capacity” field.

- Enter “% Share” without the % sign.

- In the “Business Activities” section, click on the button “+” on the right corner to provide details of business activities related to the business.

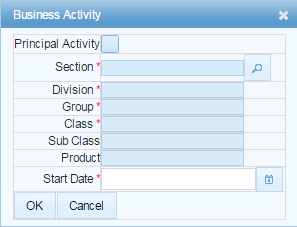

- The “Business Activity” dialog box will open.

- Fields marked with “*” are mandatory.

- Click on “Principal Activity” if it is the main activity of your business

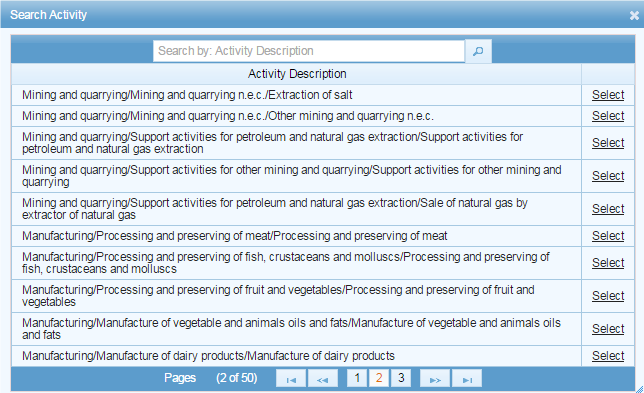

- Click on the button in front of the “” section. The “Search” dialog box will open.

- Enter the relevant business activity in the field and Click on the button on the front

- A list of one or more activities will appear in the table below.

- Click on the “Select” link at the front to select the relevant activity. The dialog box will close and the fields of the selected activity “Section”, “Division”, “Group”, “Class”, “SubClass”, “Product” will move.

- Click on “Start Date” to select the relevant date, month, year.

- After providing the information on the “Business Activity” dialog box. Click on the “OK” button.

- For multiple business activities repeat above process.

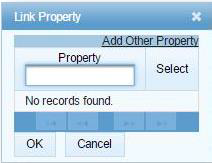

- In “Business” tab to enter business address Click on the available button “+”In front of the relevant business in the right corner of the Businesses section.

- The “Link Property” dialog box will open.

- In which there will be pre-registered addresses. Click on the “Select” check box in front to select. The dialog box will close and the selected address will be moved to the corresponding field

- Multiple addresses can also be selected.

- Click on the “Add Other Property” to enter a new business address.

- After providing the information on the “Link Property” dialog box. Click the “OK” button.

- To enter the address, follow the procedure described in the “Address Entry” step. Apply and then enter the same address in the “Address Selection Dialog Box”.

- Then click the “OK” button on the “Business” dialog box.

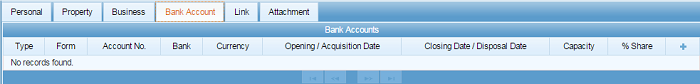

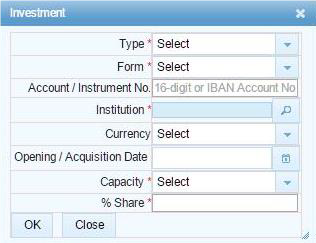

Bank Account Enrolment

- Bank account registration is mandatory.

- For this click on “Bank Account” tab.

- You will see this screen.

- In the “Bank Accounts” section click on the button on the right corner

- The “Bank Account” dialog box will open.

- Fields marked with “*” are mandatory.

- Select “Account” in the “Type” field.

- Select the corresponding value in the “Form” field.

- In the field of “Account / Instrument No.” Enter your full bank account number “IBAN” including 14 digits.

- Click on the button “”in front of “Institution”.

- The “Search” dialog box will open.

- Enter the name of the concerned bank in the field and click on the button in front.

- A list of one or more banks will appear in the table below.

- Click on the “Select” link on the front to select the respective bank. The dialog box will close and the selected bank in the corresponding field will be moved.

- Select the relevant value in the “Currency” field.

- Click to select “Opening / Acquisition Date”. And select the relevant date, month, year.

- Select the corresponding value in the “Capacity” field.

- Enter “% Share” without the % sign.

- After providing information on “Bank Account” dialog box. Click the “OK” button.

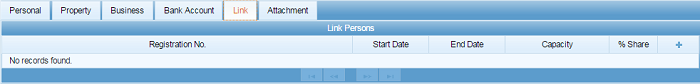

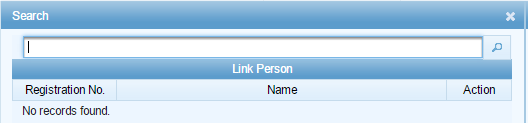

Links Enrolment

- You must register your relationship with other persons or objects.

- For this click on “Links” tab.

- You will see this screen.

- Click the button + on the right corner in the “Link Persons” section.

- The “Link Person” dialog box will open.

- Fields marked with “*” are mandatory.

- Select the corresponding value in the “Capacity” field.

- Click on the button in front of “Name”.

- The “Search” dialog box will open.

- Enter the name or registration number of the concerned person in the field.

- A list of one or more persons will appear in the table below.

- Click on the “Select” link in front to select the concerned person. The dialog box will close and the selected person “Name” field will move.

- In “Link Persons” field the same person cannot be added in the list more than once.

- Enter “% Share” without the % sign.

- Click on “Start Date” to select relevant date, month, year.

- Click the “OK” button. Available on “Link Person” dialog box after providing information.

- After entering all information related to registration, confirm their correctness and click on “Submit” button. Remember after that no change can be made in the information

- Click on “Save” button to Temporarily store information provided.

- Click on the “Print” button to take

Benefits of NTN Registration

If and individual/AOP or Company is NTN registered and tax status is Active in FBR records then they can get many benefits such as:

- Tax saving: can claim tax credit for investments, and adjust tax paid on utilities, property transaction, vehicle purchase and cash withdrawals etc.

- Lower rate of withholding tax: there are different tax slabs for filer and non-filers. Non-Filers are subject to higher rate of tax compare to filers. (Have a look at Tax Card 2023-24).

- Penalties: Avoid penalties from FBR for not filling return.

Conclusion

In final words, NTN verification is very easy and convenient process for the taxpayers in Pakistan. This enables them to file their tax return on timely and accurate basis. By verifying your NTN you take control of your tax related matter and can avoid any penalty due to non-compliance.

FAQ

NTN verification validates the tax registration status of businesses and individuals, ensuring compliance with regulatory requirements.

There are no charges for online NTN verification.

Yes, individual can verify the NTN by CNIC

For NTN verification online, go to https://e.fbr.gov.pk/esbn/Verification# and from left menu click on “Taxpayer Profile Inquiry” then select parameter type “NTN/CNIC or Passport No” then enter your selected parameter detail and enter the Captcha code and press “Verify”.

Federal board of Revenue (FBR) issues the NTN to individuals and entities.

Its recommended to verify your NTN regularly, especially before engaging in any financial transaction and tax filling season.

Yes, you can verify NTN offline by sending, “ATL (space) NTN number” to 9966. However Online NTN verification is more convenient and easier.

For company and AOP 7 digits NTN is issued and for individuals 13 digits CNIC number is considered as NTN number.

For individual NTN verification you should have 13 digits CNIC number. And of companies 7 digits NTN number is required.

Yes, NTN registration is mandatory if your annual taxable income exceeds taxable threshold.

Also Read:

How to Check Active Taxpayer List Status